|

|

|

#1 (permalink) |

|

Psycho

Location: Anchorage, AK

|

Living on my own:

So I have broke up with my girlfriend that I lived with. Now I am packing up my stuff to get out of there and I will be living with my sister for as long as I need to look for a home. I plan to buy a small ranch style home and I can afford to spend up to 1300 a month to pay for my living, (not including food, car,gas.) this is gas, electric,water and waste, insurance. stuff like that. I can do more but I choose to not do this.

I will buy this under my name and be the sole owner of this (besides the bank. lol) Now once I move to this new said place if it ever happens, then my best friend will be rooming with me. we have talked about this and he didnt want to be on the loan, and we went thru the pros and cons of this. he was ok with this to pay and not get anything other than a place to live. ( we will write up a contract seperately in the near future. any recommendations are welcome.) so I plan to move my stuff out and put the stuff in a storage for however long i need till i find a home. I will meet with a friend that knows a loan officer that can help me get a good loan, since I have great credit. so I will get the loan, then start shopping for a home, and then move my butt in. are there things to look out for that are not obvious? I know there is alot of things missing since I am new to this but I would like some help as to what to do, and in what order is better if there is. thanks! |

|

|

|

|

#2 (permalink) |

|

A Storm Is Coming

Location: The Great White North

|

For one thing, don't have anyone else on your loan. Another, get a fixed rate that you can afford and always plan on taxes and insurance going up. Get approved before you go looking. Have the potential home inspected by a GOOD inspector. Make sure you have enough for at least 10% down and closing costs plus the first year's insurance.

Good luck and have fun!!

__________________

If you're wringing your hands you can't roll up your shirt sleeves. Stangers have the best candy. |

|

|

|

|

#3 (permalink) |

|

Psycho

Location: Anchorage, AK

|

Is there a way to get 0 DOWN? I qualify for First time home buyers loans, and also the VA loan. that will not let me get 0 down? I have money to put down, but I want to use that money to buy the stuff I need once i get in the home. like a bed, and couches and tables, plates. I have never lived on my own, so this is the first time that I buy things of my own.

I will NOT have my buddy on the loan. he doesnt want to be on it, which makes it easier. I will ALWAYS plan to pay a butt load in taxes and insurance. just to be safe. I will go in on Tuesday to speak to a mortgage lender to see what I qualify for. Is there a charge I would have to pay to just see what I qualify for? like a credit check charge right? |

|

|

|

|

#4 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

have money left over from closing so that you can fix things and get things to the way you want them to be. Call it Get Ready money. It's all the things that you'll need to do in order to get ready to move in.

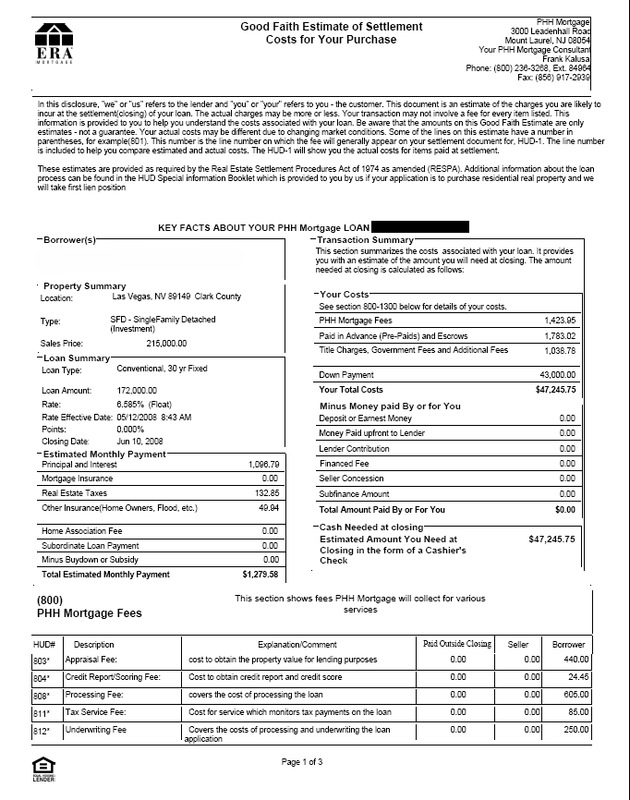

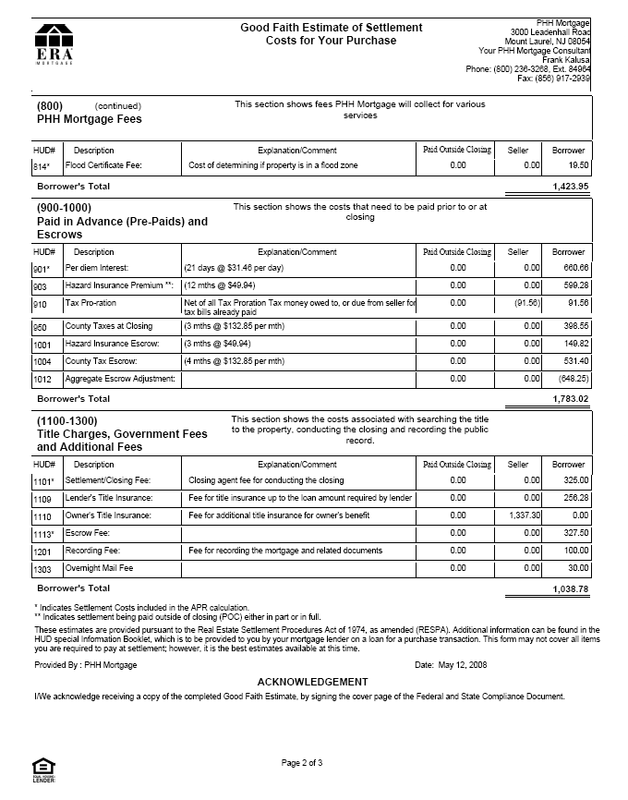

This may mean things like door knobs, changing carpet, linoleum, adding/changing light fixtures, installing ceiling fans, refrigerator, washer dryer, and the like. I'm currently looking for some investment properties and a couple other things you are ask are givebacks from the seller which are pretty standard like they pay 50% of the closing costs. 0 down will cost you more in the long run. not to mention you'll also pay more for PMI which isn't required once you hit 20%. It's also harder to get 0 down nowadays since the mortgage crisis. If you have some assets already like another property but it doesn't sound like it. No it costs nothing it is FREE to "pre-qualify" any lender can do it over the phone and give you an idea how much money they will lend you. How much do you plan on putting down? and what price range do you think you're looking at? if you are living with your sister, live with her longer than you are considering so that you can have even more money to purchase and get ready your home. I spoke with someone in the mortgage/housing business last night and he explained to me that there's more bad to come in respect to housing. His explanation is that this means prices will continue to decline as inventory increases since more people will default on their shaky loans. It will cause a glut in inventory and thus bring the over all prices of homes down as the market slowly corrects. I don't know what to make of it, but he was dead on with the Bear Stearns deal. I have to make a purchase this year as my finances will change in the next year or two to an unknown state. I'm also in for the long haul (10+ years) so even if I pay $10-$50,000 more for the house my investment will grow accordingly and better than sitting in a bank account. Ultimately if you are able to stay with your sister to save money, save money like crazy. We ate peanut butter and jelly for 2 years while renting to make sure we had enough money to make the purchase we did. simply put, don't rush this process. the longer you wait the better standing you'll have. if you have even small dings in your credit you'll also be able to correct them and get a higher FICO score which will also save you money by giving you a better interest rate. forgot to add: First Time Buyers is a nice incentive, but sometimes you are able to get better rates via a regular loan. The important thing is to shop for them. Once you contact a lender, they'll send you a prequalification letter. This makes realtors happy because they know you are serious and not just shopping.  Note: The interest rate is higher because we are looking at investment properties, not primary residences. We could have had the letter for $300,000 but I didn't want the lender to show me more house than I was looking for. I'm in a particular target for $200,000 and with 20% down this is the right figure. here's the Good Faith Estimate (GFE) that a lender sent me the other week when we were shopping for homes. It should give you some idea for all the little items that people haven't the foggiest idea as to what all these closing costs are actually covering.    You also are not required to get your mortgage with whomever gives you a prequalification letter.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. Last edited by Cynthetiq; 05-24-2008 at 11:47 AM.. Reason: Automerged Doublepost |

|

|

|

|

#5 (permalink) | |

|

A Storm Is Coming

Location: The Great White North

|

Quote:

One thing I neglected to mention previously - when you own a home and have interest/tax deductions for it, you may be able to add more deductions in your regular paycheck. I would see a pro to discuss your situation but that could give you more cash on hand each month.

__________________

If you're wringing your hands you can't roll up your shirt sleeves. Stangers have the best candy. |

|

|

|

|

|

#6 (permalink) |

|

Psycho

Location: Anchorage, AK

|

dang. this is not looking good for me then. I mean I have about $20k in my savings, but I dont want to use that for a home, i want to save it for a rainy day. i saw that you are putting about 40k down? wow, thats awesome.

the loan that I calculated from last year when i went to do this, was about $177k to get a home/townhouse/condo. now I made alot more this year, so it should go up but still, at about 180k mortgage, i saw on the loan calculator my payments would be about 1000/mo mortgage alone. that looked good to me, though i do understand that it was just an "estimate." but now hearing that getting 0 down will be hard maybe even impossible. Im wondering what other options to do. I mean I could stay with my sister but her place can only hold me up for so long, ( small place.) I guess I could rent for now, but I just HATE moving. When I went last year it seemed so easy to do, but now with seeing that I need a downpayment that big, I jsut dont know anymore. |

|

|

|

|

#8 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I'm not trying to sway you from buying a home. thingstodo is right, look for a less expensive home. Look for the same things that are in the more expensive ones, since they tend to attract better buyers. Examples of this are 2 bedrooms versus 1, 3 vs. 2, garage versus covered parking.

I'm not sure where you are in the US, I assume AK by your profile, but are there any properties that you can purchase in your area that are in the $75,000 range? It may be a 1 bedroom condo/townhouse, it gives you ample 20% and move in money. here are a couple thoughts about the 20k you have for savings... Think of the 20k you are putting into the house for savings.. it is for longer term savings than "rainy day" but more like 10-30 years down the road. Yes, you'll start your rainy day fund over again, but if there was a "rainy day" that required your attention, you could have other new options like home equity line of credit (HELOC). The caution is to not over borrow for frivilous "rainy day" things, like new TVs, cars, and other depreciating assets. HELOCs are best setup mainly for improving the house in some manner, like new roof, carpeting, new kitchen, bathroom improvements, etc. The more you pay upfront the less you pay in the backend. If you look at mortgage calculators and calculate the total payments over 30 years, you'll see that you've paid almost twice the amount of that you borrowed to originally purchase the house. If you were to move in with your sister, you state "small place," does that mean you'll be sleeping on the sofa? have your own room? If you were to scrimp and save all that you could, how much would you be able to save in 1 year? this should give you an idea and goal as to what the timeframe you'd realistically be living with your sister. just because the amount you're able to borrow goes up doesn't mean that it's a better deal for you. it means you're qualified to buy more house, but also means you're on the hook for more in monthly payments especially if you choose to not put 20% down.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#9 (permalink) | |

|

Psycho

Location: Anchorage, AK

|

Quote:

www.alaskarealestate.com ( look here and browse for my town, and you will see what I am talking about. I am looking for a home that has like 2 bedrooms, and about 1000sqft. I am not picky. it doesnt need to have a garage or car port. i dont mind old heating instead of forced air. i just want something I can build on to if i want, and to be able to have some people over. also have something that I dont hear the neighbors snore. Not like those houses /apartments that you cant have more than like 3 ppl over and feel too crowded. I can get a cheaper home but we would be talking about mobile homes. (which I do not want.) since they are pushing to remove all mobile homes from my town. also the neiborhood is not what I am looking for. more like those old ranch style homes that have a basement type. nothing new. So as for getting rid of my $20k, if I dump it into my home, if somethign comes up to pay for, I can use my home or HELOC to cover that? what is the penalty? what are the pros and cons in laymans terms? When I say small place with my sister. is that she lives in a small 2 room mobile home, and she has a daughter and I dont want to be a bother with me sleeping on the couch. I know she wouldnt mind but I dont feel like i should. well my bills are about 900 bux a month with no living bills, though I would help my sister out, and then i make about 3000k a month. may seem like alot, but I think i would need to cut back on spending. lol I do understand about the whole. "hey the will loan me more money" statement. by saying that though is that they see that I could pay that amount but i wouldnt even be close to match that if I could help it. my mind doesnt work like that. also is it true that if i was to pay once a year double my mortgage I can take off 7years? if that were true. I would do this once a year every year, since we get the state Permanent Fund Dividend, and i save that every year anyways. |

|

|

|

|

|

#10 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Interesting housing market...

I'm looking at many things there and it looks like you're market is in the $150k-$179k range. Some of these are also older homes which means that some will or may require major maintenance like roof, heater, etc. I am not such a fan of mobile homes, my grandparents bought one a few years back. It's nice, huge, 3 bedroom doublewide, but it still is cheap feeling. re: the HELOC once your home gains equity, you can borrow against it. You set up the line of credit at a particular rate, and it sits idle until you borrow any money against it.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#11 (permalink) |

|

Psycho

Location: Anchorage, AK

|

update: well i got a call from a mortgage officer, and she will get back to me later on in the day, and she said that I qualify for the VA loan, which backs 100% so I do not anything down. I know I will pay more in the end, but i plan to put my Permanent fund dividend and my work dividend that i get every year, on my mortgage, whenever i get a chance. I will pay more than what the mortgage is if it is not too high.

we will see what she says later on today. UPDATE: I got approved for about $160k. my payments woudl be about $1293/mo with insurance, and taxes. so i think I just have to find a place. I am going to try to get lower than 160k as i can for a place. Last edited by blktour; 05-27-2008 at 04:10 PM.. |

|

|

|

|

#13 (permalink) |

|

immoral minority

Location: Back in Ohio

|

It does look like an interesting housing market there. As someone who bought their first house 5 months ago, there are a few unexpected expenses.

How soon are you going to be buying this house? Have you found a few to look at yet? When you are looking, be sure to take a guess at what your needs may be 5-10 years from now. It costs a lot to sell and move to a new place with an extra bedroom or in a better location. Make sure you always have 4-6 months of mortgage payments in the bank. But, you may consider putting 5-10k down (I had 2-3k in closing, taxes and inspection fees, I think.) Buy the necessary things gradually as you earn the money for them. Except for a bed/mattress... But just make sure everything feels right, and don't buy a bad house because you could save $200/month. The reason why I work and make money is to be able to live in a nice house. There is no point in making plenty of money if your quality of life isn't what you want. |

|

|

|

|

#14 (permalink) |

|

A Storm Is Coming

Location: The Great White North

|

Congrats!! Make sure you get an inspection from someone really good. If they don't find anything they're probably not very good!!

__________________

If you're wringing your hands you can't roll up your shirt sleeves. Stangers have the best candy. |

|

|

|

|

#15 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

congrats!!! that's a great thing you've got available the VA loan....

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#17 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

how goes the house hunting?

I was just back in Las Vegas looking at properties. In 2 days we looked at almost 15 properties in various states, some almost move in condition, and others in OMGWTF did they do to this place? We put an offer on a 5 bd, 2.5 bath... we should know today if they accept the offer.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#18 (permalink) | |

|

Psycho

Location: Anchorage, AK

|

Quote:

wow! I would love to be able to afford something like that. my job hunting is still going. I am in the process of closing on a condo that is in my price range, that had been recently upgraded as far as flooring, roof, furnace, water heater, doors, windows, new paint, inside and out. it is 2 bedroom 1 bathroom, 100sqft. ( this is just for me.) I offered 150k and they cover closing costs, and they took it. now I just have to put in some paperwork that they need. and then hire an inspector, but im still new to the whole VA inspector deal. I dont nkow if i have to hire him, or the VA office hires him? but we shall see. oh and the ernest that i put down, they already took out that money. what will happen with that? |

|

|

|

|

|

#19 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

In my case I have to hire the inspector, costs for me is about $375 or so. I'm not sure what you are required, but ask your broker. He should be a wealth of information, if you don't have a broker, contact the seller's broker. You're going to kill me for this but take a look... Mind you someone got screwed on this property since it's a bank owned property. I just got lucky in finding a deal. The earnest money deposit will go towards your downpayment. When you close you bring a check for the rest of the balance due.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#20 (permalink) |

|

Psycho

Location: Anchorage, AK

|

WOW!!! that is gorgeous!! I did have a thought of "killing you" in my head for a second. haha, j.k.

So what if I had 0 down, how does that go? I offered 150k and they do closing costs, and i have 0 down. where does that Ernest money go to? |

|

|

|

|

#21 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I don't know this for fact, but since it is zero down they should give you back your earnest money deposit in full once you've closed escrow. The money is held as "damages" if you default in any way on completing the closing. There are of course "outs" you have such as if there are and CC&R (convenants, conditions, and restrictions) these are by laws for homeowners associations and the like, and after inspection where if you find out that the house isn't worth buying at the original accepted offer price because there are needed repairs like roof repair, mold, HVAC issues, etc.

Ask your broker to be sure.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

| Tags |

| living |

|

|