have money left over from closing so that you can fix things and get things to the way you want them to be. Call it Get Ready money. It's all the things that you'll need to do in order to get ready to move in.

This may mean things like door knobs, changing carpet, linoleum, adding/changing light fixtures, installing ceiling fans, refrigerator, washer dryer, and the like.

I'm currently looking for some investment properties and a couple other things you are ask are givebacks from the seller which are pretty standard like they pay 50% of the closing costs.

0 down will cost you more in the long run. not to mention you'll also pay more for PMI which isn't required once you hit 20%. It's also harder to get 0 down nowadays since the mortgage crisis. If you have some assets already like another property but it doesn't sound like it.

No it costs nothing it is FREE to "pre-qualify" any lender can do it over the phone and give you an idea how much money they will lend you.

How much do you plan on putting down? and what price range do you think you're looking at?

if you are living with your sister, live with her longer than you are considering so that you can have even more money to purchase and get ready your home.

I spoke with someone in the mortgage/housing business last night and he explained to me that there's more bad to come in respect to housing. His explanation is that this means prices will continue to decline as inventory increases since more people will default on their shaky loans. It will cause a glut in inventory and thus bring the over all prices of homes down as the market slowly corrects.

I don't know what to make of it, but he was dead on with the Bear Stearns deal. I have to make a purchase this year as my finances will change in the next year or two to an unknown state. I'm also in for the long haul (10+ years) so even if I pay $10-$50,000 more for the house my investment will grow accordingly and better than sitting in a bank account.

Ultimately if you are able to stay with your sister to save money, save money like crazy. We ate peanut butter and jelly for 2 years while renting to make sure we had enough money to make the purchase we did.

simply put, don't rush this process. the longer you wait the better standing you'll have. if you have even small dings in your credit you'll also be able to correct them and get a higher FICO score which will also save you money by giving you a better interest rate.

forgot to add:

First Time Buyers is a nice incentive, but sometimes you are able to get better rates via a regular loan. The important thing is to shop for them.

Once you contact a lender, they'll send you a prequalification letter. This makes realtors happy because they know you are serious and not just shopping.

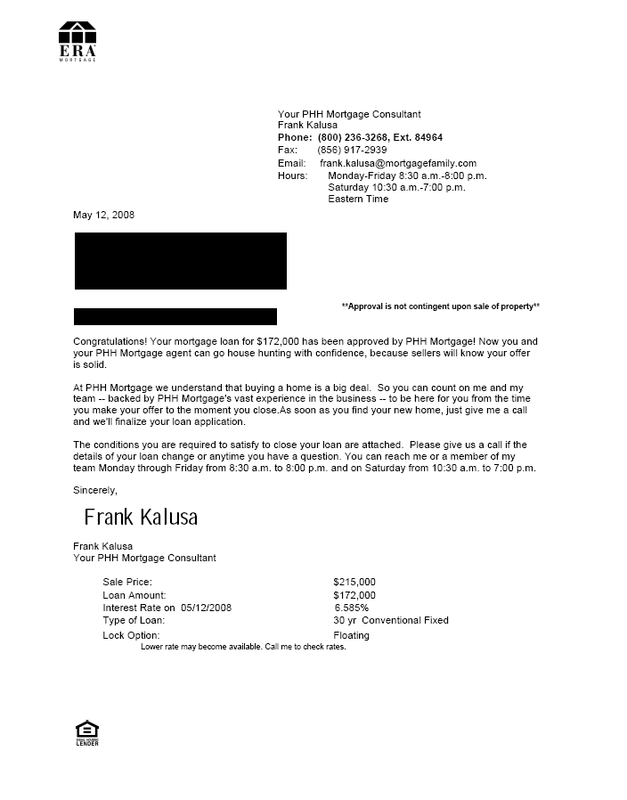

Note: The interest rate is higher because we are looking at investment properties, not primary residences.

We could have had the letter for $300,000 but I didn't want the lender to show me more house than I was looking for. I'm in a particular target for $200,000 and with 20% down this is the right figure.

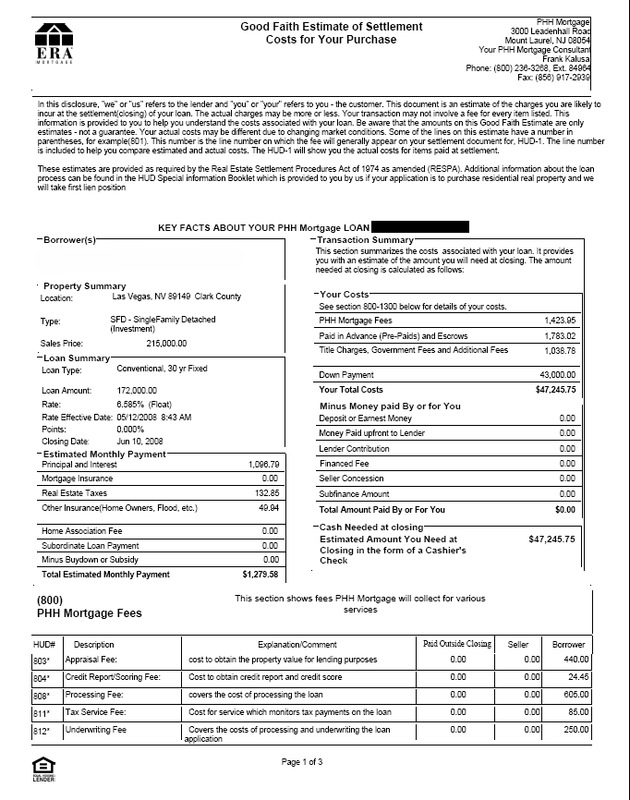

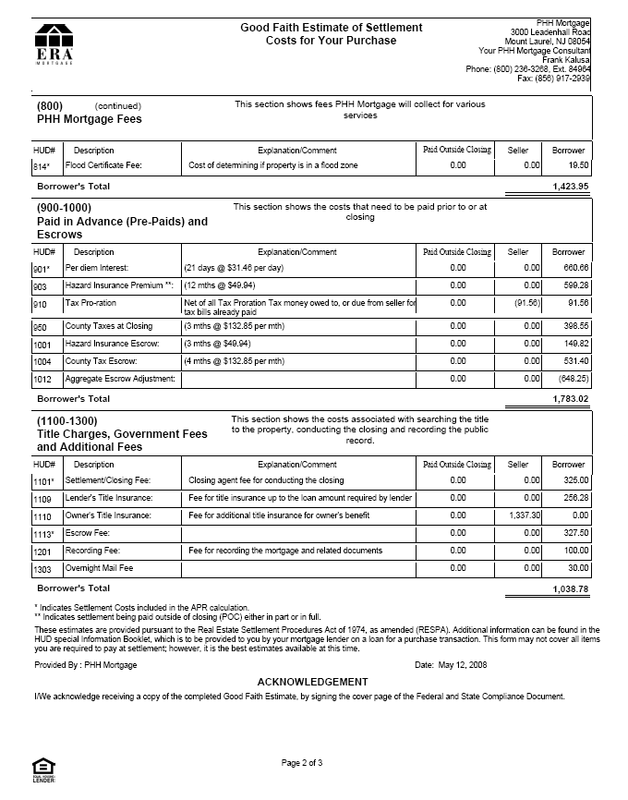

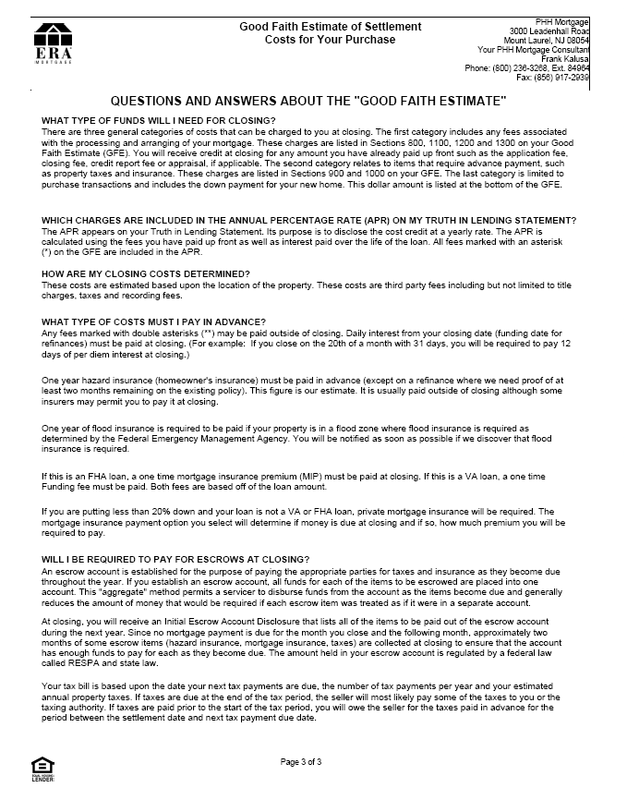

here's the Good Faith Estimate (GFE) that a lender sent me the other week when we were shopping for homes. It should give you some idea for all the little items that people haven't the foggiest idea as to what all these closing costs are actually covering.

You also are not required to get your mortgage with whomever gives you a prequalification letter.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not.