|

|

|

#1 (permalink) | |

|

... a sort of licensed troubleshooter.

|

This is Not a Bull Market Stocks Are Not Up and They’re Headed Even Lower

Apologies for the slightly depressing title, but why lie?

Quote:

It's long past time we start to be honest about what's really going on. It hurts, finding out that things really aren't picking up the way MSM is trying to suggest, but isn't it better to come at this as objectively as possible? Like the article says, I believe in buying precious metals and gems, commodities, and companies that have products that must increase in cost with inflation. I know it's tempting to buy into things that dropped to the floor recently because it seems like they have nowhere to go but up, but the smartest people I know keep telling me that's not a good idea. You need to be safe. We all do. I've got a bit in commodities right now simply because I'm not comfortable with everything in the bank (right now, Wells Fargo seems to be the safest US bank, but who knows?). What's your take on the reality of the market? Bear or bull? What are you investing in (feel free to be vague here if you're not comfortable)? How much are you keeping in the bank for fear that nothing is safe? Do you think the banks are safe? |

|

|

|

|

|

#2 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Wait, who said it was a bull market?

From sources I trust, we are smack dab in the middle of a secular bear. It started at around 2000 and could continue up until 2015 or so. A wealth manager I work with has been telling her clients, her readers, and the media that right now is a good time to be parking a lot of things in cash. You don't want to lose money? Don't put it all in the market. The best money managers out there know that you don't (and shouldn't) always be fully invested. Buy & hold (indefinitely) is almost never a great strategy. This whole thing might seem shocking to many because of common perceptions of the markets. But it's the herd mentality that causes much of the problem in the first place. Greed and myopia are interrelated.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#4 (permalink) |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

Then it's up no one thinks it's going to fall. When it tanks no one thinks it's going to recover.

I was down 48% last year. Most of that in that last 4-5 months. Now I'm down 18%. Never thought I'd be happy about being down only 18% but thats where things are right now. Could it tank again? Sure. Could it keep crawling out of the hole? Possibly. There's still stuff out there that can make you money. I bought BAC when it was around $4 and sold it when it hit $12. I've also bought some stock that was low and never seemed to do anything but flat line. I've got hook into a couple Mutual Funds that have absolutely tanked recently. No one bats 1000. So far I'm still doing better this spring then last winter. I see hope. Not bright gleaming hope ready to rise tomorrow but hope none the less. I still think real estate is a good buy. But what do I know? I think at a 1.80 AIG is a pretty attractive deal. And they could well be the next Enron.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

#5 (permalink) |

|

Nothing

|

It does look very like this particular bounce is about to crash again...

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#6 (permalink) |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

Yeah that kind of been the trick for the last few months- following the bouncing ball and sell the minute it begins it's free fall.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

#7 (permalink) |

|

Nothing

|

Well I hope you're not caught out, man... It could just take one 'event' on top of the unrelenting bad news - a lack of EVEN WORSE news is still awful news atm - to send the whole lot into a tailspin again...

Probably including the bond market this time, too... Best of luck.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#8 (permalink) |

|

Junkie

|

I find it interesting the similarities and differences in language used here: http://www.tfproject.org/tfp/tilted-...arkets-up.html

|

|

|

|

|

#10 (permalink) |

|

... a sort of licensed troubleshooter.

|

They're simple labels for what are generally complex situations. Considering how complicated economics can get, people desperately want available to them simple concepts. "Bear" and "bull", in most minds meaning "up" and "down", are a lot easier to not only comprehend but operate with as a framework.

|

|

|

|

|

#11 (permalink) | |

|

WHEEEE! Whee! Whee! WHEEEE!

Location: Southern Illinois

|

Quote:

__________________

AZIZ! LIGHT! |

|

|

|

|

|

#12 (permalink) |

|

Nothing

|

This just bakes it in.

Actual numbers, measures of reality, are released today and show enormous amounts of gloom everywhere. A single report on confidence goes up a touch, a report that was showing high levels throughout the beginnings of the economic troubles all the way up to September 2008, and the markets 'surge' on the news. Reality = Awful Perception = not quite as bad as we thought it might be, however baseless Markets add billions to general values. Really, you need to be a wizard, not a genius, to work on Wall St.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#13 (permalink) |

|

Eat your vegetables

Super Moderator

Location: Arabidopsis-ville

|

When it looks like a stock is up a lot, double-check what you're looking at. Is it trading in high volume? Probably not. This is definitely a bear market.

__________________

"Sometimes I have to remember that things are brought to me for a reason, either for my own lessons or for the benefit of others." Cynthetiq "violence is no more or less real than non-violence." roachboy |

|

|

|

|

#14 (permalink) |

|

Super Moderator

Location: essex ma

|

keep in mind that the dj industrial numerical meme appears one the nightly news and is understood to be a kind of astrological indicator of the well-being of the zeitgeist--all things thereby have the same interests as capital--but the nightly repetition of this Important Ideological Factoid has been a constant since the early 1970s. so what matters really is less what the meme means than what it does.

what it's supposed to do is indicate All Is Well or at least ok or will be. it's basically a very short weather report, except it covers the All. the connection of indices to the actual generation of surplus is secondary. so an opinion management tool--a small one, but since it encompasses the All, it's kinda important. so it follows that if you have to truncate the timeframe that you're using to say "things are lookin up sports fans" its a small price to pay. so what if it's meaningless? the effects are Important: consumers recover a bit of Confidence and begin to do their patriotic duty as americans and exercise the one freedom they have in any immediate sense which is to Buy Things. Buying Things is Good. the Good is an expression of the Beneficience of the All. i'm sure you've overheard or maybe participated in conversations over the past months that the "real" problem is Bad News and that nothing Bad is really happening, it's all the fault of the Media... uh.. yeah.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#15 (permalink) | |

|

Psycho

Location: the center of the multiverse

|

Quote:

Whatever, it's a Catch 22: Companies are laying off people in bloody masses because people aren't spending money, and people aren't spending money because companies are laying off people in bloody masses. Oh, what a world! What a world... |

|

|

|

|

|

#16 (permalink) | |

|

Junkie

Location: upstate NY

|

Quote:

That's perfectly well and good but there are other ways to skin the cat. I trade using technical analysis. Any chartist will tell you that the current primary trend of the market is down. We have had a very powerful bear market rally the last few months. Depending on the extent of the current pullback and the subsequent rally we could re-enter a primary uptrending (ie bull) market at some point. There are good ways to make money in either condition but for most investors with a long only bias and a tendency to hold positions long term, waiting for a primary bull makes sense. |

|

|

|

|

|

#17 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

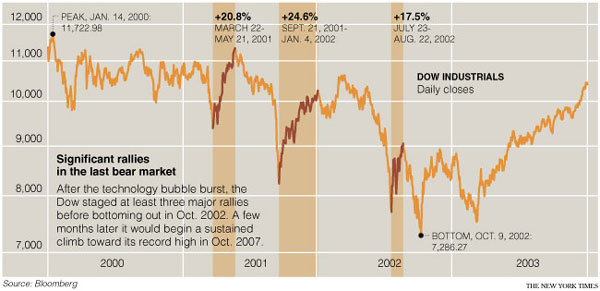

It's been very beary since 2000:

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#18 (permalink) |

|

Crazy

Location: East Texas

|

It seems to me that we started hearing that the market was bullish after people in power (ie moneyed individuals) realized that as long as the media reported that the market was down/dismal/etc. then average joes would not invest in there "sure thing" blue chips, or anything in general. As soon as the newsmedia (see CNBC or "mad-money" Kramer) starts telling people that it's A-OK to invest again, they will. It's a self-fulfilling prophecy.

There is money to be made in either a bull or bear scenario, and the smart investor knows this. But, as stated above, most investment firms are long-term oriented and prefer bull markets. Hence the effort to bring the masses back to the stock market via mass-media propaganda. Maybe I should have posted this under "tilted conspiracies"...

__________________

These are the good old days. How did I become upright? |

|

|

|

|

#19 (permalink) | |

|

Nothing

|

Quote:

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

|

#20 (permalink) | |

|

Junkie

Location: Ventura County

|

Quote:

The people who went to cash/shorted the market/etc. in early 2000, then started to re-invest in 2003, went to "cash" in 2008 and are now re-investing are experiencing a tremendous "bull" market. Even those with less than perfect timing but with a discipline to minimize losses and to follow (rather than trying to anticipate) market shifts in market trends are doing pretty well. The market is a teacher, wise people learn from the past. Financials were greatly under valued a few months ago, they have had a good run and are now consolidating. Energy stocks are following a similar pattern, when oil reach its low a month or so ago, energy stocks were under valued. Now they are running strong. I expect they will reach a peak when the price of oil does. Technology is due for a run, we are just waiting for the next big thing. I don't think the next version of Windows is going to do it, but it is possible we will see a big upgrade cycle in the PC market. The china market is going to out perform the US, FXI is a eft and a good way to play China. Small cap stocks will out perform large cap stocks when economic growth is strong, I expect the economy will start to grow again starting later this year, but small cap stocks will move before you get data on that. Infra structure companies and commodities, like copper/steal were hit hard and will see a bounce as well. I am betting the "green" stocks go nowhere, I think it is mostly hype. I am avoiding windmills, solar, and nuke power. Oh, and I love the dividend yield on the cigarette company Phillip Morris. They are in business with the government (taxes,settlements to state governments, child health care) so they will be protected from competition and from going out of business. The dividend is safe.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

|

#21 (permalink) |

|

Nothing

|

Ace, care to offer an opinion in movement of the dollar vs 'the market'?

I mean, the dollar drops 2% and the markets go up 1%. YAY BULL! (shit) and we're due for a big run up in pc's? Why exactly? and did you see dell's latest results together with intel's comments from a couple months back? :-O

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- Last edited by tisonlyi; 06-01-2009 at 09:00 AM.. |

|

|

|

|

#22 (permalink) | ||||

|

Junkie

Location: Ventura County

|

Quote:

Quote:

Quote:

Quote:

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||||

|

|

|

|

#23 (permalink) |

|

Easy Rider

Location: Moscow on the Ohio

|

The market is very hard to figure out. If that were not so then we would all be rich. The one thing I've learned over the years is that when most people are bullish it is generally a good time to sell and when most people are bearish it is generally a good time to buy. I don't think this works on those rare occasions when the market resets due to dramatic changes in fundamentals like unforseen credit crisis etc.. I don't think many of us would have held stocks last fall if we had known about all the upcoming bank failures.

|

|

|

|

|

#24 (permalink) | |

|

Nothing

|

Quote:

Chipzilla (Intel) will make a tonne of cash for a reasonable way into the future. That's a 100% banker, if you have a look at how far ahead they are in technologies for processor speed, effective multi-processors, lower power consumption, etc and ponder the increasing dependence and silicon in our lives and societies... My $0.02. As for the the other stuff, apart from the topic of Dell, i think it's fair to say we don't agree. You think the paradigms haven't changed, I think the game is bloodied and dying, engaging in death spasms as we watch. Welcome to the bond market blow out or some MAJOR hyper-inflationary gasoline in the auctions this week. ---------- Post added at 11:05 PM ---------- Previous post was at 11:02 PM ---------- OUCH. Global Crisis ?Inevitable? Unless U.S. Starts Saving, Yu Says - Bloomberg.com

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

|

#25 (permalink) |

|

Junkie

Location: Ventura County

|

I think market paradigms change all the time. I also think that is the game. The investor who is on top of paradigm changes will always find ways to profit in the market.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

#26 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Those who weather them tend to be of two kinds: 1) those with a properly diversified portfolio, 2) contrarian investors.

Unfortunately, there are many who don't know what true diversification is and many who think contrarian investors are simply bat-shit crazy.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#27 (permalink) | |

|

immoral minority

Location: Back in Ohio

|

Quote:

It is a good company, and they don't have much competition, but they are all ready big and they aren't going to be able to grow very much. People are happy with the computers they have, and I don't see a revolutionary CPU coming out in the next few years. Then again, people are waiting for Windows 7 to come out in October before they buy new computers. And others are waiting for September for Apple to release OSX 10.6 with their new computers. |

|

|

|

|

|

#28 (permalink) |

|

Junkie

Location: San Francisco

|

It is really hard for normal people to make money on the stock market. There is an entire industry of people who make careers out of taking your money.

__________________

"Prohibition will work great injury to the cause of temperance. It is a species of intemperance within itself, for it goes beyond the bounds of reason in that it attempts to control a man's appetite by legislation, and makes a crime out of things that are not crimes. A Prohibition law strikes a blow at the very principles upon which our government was founded." --Abraham Lincoln |

|

|

|

|

#29 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

People like the idea of making money in stocks, and perhaps they'll look at bonds as the "safe and wise" thing to do...you know, to "diversify." It's only when you get yourself a proper financial advisor (not just a broker) who will also let you know about the function of holding cash (T-bills), real estate, and other vehicles that can be unaffected by conditions that wipe out stock values. Modern portfolio theory has been around for how long now? Haven't enough people learned their lesson? Maybe it's just greed, because with the information and products out there, it really is as easy as picking what level of risk you're comfortable with. I guess some people are merely concerned with making as much money as possible. But it's funny—you can't escape taking on as much risk as necessary.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

| Tags |

| bull, headed, lower, market, stocks, they’re |

|

|