Apologies for the slightly depressing title, but why lie?

Quote:

How do you measure wealth generation?

1) Average annual gains?

2) Gains relative to an underlying index (the S&P 500)?

3) Gains relative to inflation?

Of these three, the last is the only real means of gauging wealth creation or destruction. Commentators have been going bananas over the fact that stocks are up 20%+ since their bottom of 666. No one mentions that this rally may actually be induced by the Federal Reserve pumping trillions of dollars into the financial system.

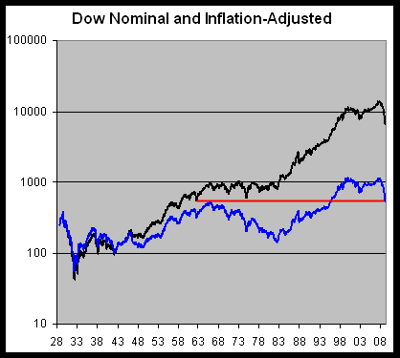

Similarly, no one mentions that adjusted for inflation, stocks are still WAY down from their peak during the Tech bubble.

Source: Crossing Wall Street

As you can see, stocks entered a bear market in earnest following the Tech Crash. Yes, in number or nominal terms, the Dow has risen. But you have to remember the dollar lost roughly a third of its value from 2001 to today. Measuring stocks or anything in dollars between now and then was like measuring with a ruler that was continually shrinking.

Also, bear in mind that the above chart is using the Government’s phony measure of inflation: the Consumer Price Index [CPI] which DOESN’T include food or energy prices. Using accurate inflationary data, stocks are down even more in real terms.

My main point is this: inflation is an ever-present reality in the post WWII era. Investors need to be protecting themselves from this beast at all costs. You can do this by:

* Buying gold

* Buying commodities or real assets

* Buying companies that can offset inflationary costs by raising the price of their products

I suggest having some money in all three. It’s the only certain way to protect your wealth from inflation. The Feds are cooking up an inflationary storm of epic proportions, pumping TRILLIONS of dollars into the financial system. Stocks may rally like a rocket-ship from here. But in real terms they’re still tanking.

After all, if the Dow hits 30,000, but you’re celebrating by drinking a $150.00 coke… are you really any richer?

|

This is Not a Bull Market: Stocks Are Not Up, and They?re Headed Even Lower -- Seeking Alpha

It's long past time we start to be honest about what's really going on. It hurts, finding out that things really aren't picking up the way MSM is trying to suggest, but isn't it better to come at this as objectively as possible?

Like the article says, I believe in buying precious metals and gems, commodities, and companies that have products that must increase in cost with inflation. I know it's tempting to buy into things that dropped to the floor recently because it seems like they have nowhere to go but up, but the smartest people I know keep telling me that's not a good idea. You need to be safe. We all do.

I've got a bit in commodities right now simply because I'm not comfortable with everything in the bank (right now, Wells Fargo seems to be the safest US bank, but who knows?).

What's your take on the reality of the market? Bear or bull? What are you investing in (feel free to be vague here if you're not comfortable)? How much are you keeping in the bank for fear that nothing is safe? Do you think the banks are safe?