|

|

|

#41 (permalink) |

|

Junkie

Location: Ventura County

|

Those are interesting charts and graphs, but...

One of the points of a progressive tax policy is to social engineer. One of the unintended consequences is that low wage earners have major disincentives to earn more because of large marginal tax rates. If a person has the opportunity to earn an additional $5,000 but would face the lost of a tax credit or be put in a higher tax bracket that costs him $3,000 would he do it? Depends right? But the point is don't we need to look at after tax income trends or neutral, adjusted for taxes, income trends? Another problem is that the people in the percentiles is not stagnant. Generally average people start in a low percetile and reach their personal highest percentile in their 50's or early 60's and then they go down. So a person who is 18 and dropped out of H.S. is hurt the most. But the 18 year-old who goes to college gets a minimum wage job while in school, then goes to grad school while working an entry level job, and then gets a Phd. may hit the top percentile in their 40's and only stay their until retirement. So what does the above graphic information really tell us? Not much. What we do know is that when Bush cut taxes, the tax dollars collected by the federal government went up, not down. what does that tell us? And who benefited from that?

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

#42 (permalink) |

|

Crazy, indeed

Location: the ether

|

That there is mobility doesn't negate the fact that the rich fared better under Bush than anyone else. And in any case, mobility is extremely slow. Most mobility happens over the course of a generation, so the vast majority in each quintile in those graphs were in the same quintiles in the 1990s.

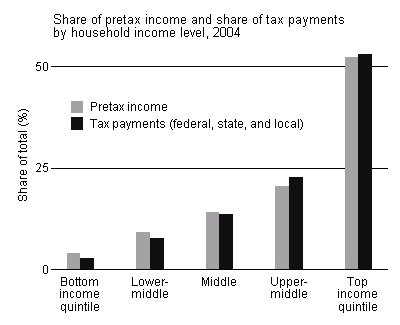

And we also know that tax dollars collected by the federal government went up because of an increase in receipts from social security taxes, not from personal income taxes. Historical Amount of Revenue by Source So if anything the Bush tax cuts were even more regressive than suggested, given how the taxes on capital gains (which favor disproportionately the rich) were cut, but not those on social security (which affect mostly wage earners). Or, to illustrate it even better:  |

|

|

|

|

#43 (permalink) |

|

Junkie

Location: NYC

|

dippin, there are lots of ways to massage those numbers. Try looking at how much of each person's tax burden was cut. You'll see the graph turned roughly upside down. If you want to talk about marginal utility of the cuts, it's much greater at the bottom.

But look, progressivity of tax burden raises lots of other issues. The only thing it's really good at is biting the people at the top. It's less thanc lear how much it helps those at the bottom. |

|

|

|

|

#44 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Effective Federal Tax Rates Under Current Law, 2001 to 2014 |

|

|

|

|

|

#45 (permalink) |

|

Junkie

Location: NYC

|

Sure, that's true, but it always comes back to what sorts of activities one wants to tax and at what levels. And then you have to have a theory about why capital gains should be treated the same as income, and you'd need to account for the fact that changing the capital gains rules affects how much tax gets paid because the asset owners have ways to avoid recognizing the gains, most easily by refusing to sell.

I suppose we could just mindlessly cap everyone's income from any source, and tax away everything above a certain level. That might satisfy some urge of yours that you choose (erroneously) to call "fairness," but it also would be highly destructive and economically insane. |

|

|

|

|

#46 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

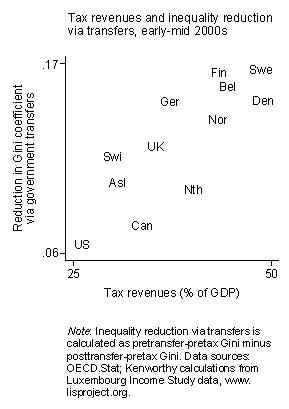

The fact is that taxes were significantly more progressive during most of the 20th century in the USA, and remain significantly more progressive in other developed countries with none of the so called destructive effects people like to talk so much about. |

|

|

|

|

|

#47 (permalink) |

|

Junkie

Location: NYC

|

That's simply not true. Tax rates were nominally more progressive, but the actual rates paid at the top were not very much different from what they are now, because the tax code was riddled with exemptions, shelters and other such things. That in itself created unproductive activity (tax-saving-oriented planning and investment instead of productive planning and investment), which means that the economy likely would have been even better with a sane tax structure. But you're confusing nominal rates with actual rates, and the two have only a tenuous relationship to one another. The fact is that taxes actually paid are more progressive today than they have ever been in history. The bottom half of the income scale pays something like 3% of the income taxes. The top 1% pays something like 40%. I believe the top 5% pays something like 70%. You claim not to want to cap or confiscate, but how much more progressive do you think you can make the tax system than it is right now? You can make it saner and simpler but it can't get very much more progressive. The tax system has many things wrong with it, but lack of progressivity isn't one of them.

|

|

|

|

|

#49 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

That is the effective tax rate. And if you look at tax share of income:  So as you can see, the difference between the top and the bottoms has reduced by quite a lot. In fact, the current system, when take all taxes into account, is barely progressive. The whole thing about the top paying the vast majority of taxes happens because the top has the vast majority of income:  It is specially not progressive when compared to other nations (considering taxes and transfers):  If you want to really go at this, this paper really addresses all of this: http://elsa.berkeley.edu/~saez/piket...P07taxprog.pdf And if you don't want to read all of that, here's the bottom line:  these are the effective total tax rates, so your whole bit about nominal vs effective is actually false. So yes, the American tax system was significantly more progressive in the past. And it was so when you look at individual income taxes, but even more so when you look at the total share of income paid in taxes by each group. That is specially so because taxation has shifted significantly from capital to labor. Last edited by dippin; 12-15-2009 at 09:41 AM.. |

|

|

|

|

|

#50 (permalink) |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Serious question:

What does a "rich" man receive from the federal government that a "poor" man does not receive?

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

#51 (permalink) |

|

Who You Crappin?

Location: Everywhere and Nowhere

|

Assuming that this "rich" person lives among other "rich" people (and not among the "poor"), his taxes buy him better roads, better hospitals, more police protection, better hospitals, better schools, etc. You could say that they are "buying" those things with their tax money

|

|

|

|

|

#52 (permalink) |

|

Junkie

|

I am still waiting for someone to explain to me how, if it is wrong and immoral and illegal for me (an individual) to rob someone at gunpoint (even if I give him some of his money back or buy him a drink afterwards), it is right, moral, and legal for the Government (a mob, a group of individuals) to do so. Every time I ask, the only response I seem to get is "oh not again.*"

Seriously; if it is immoral for an individual to do Thing X, why is it moral for a group of individuals to do Thing X? Because it's popular? Because enough people say so? I've already been informed by one individual here that yes, that's exactly what it is: "political consensus is all that's required." If that's -really- all it takes for an immoral act to become a moral one, what exactly did the Nazis do wrong, or the Soviets, or the Red Guards? *There, Derwood, now you can save your Snide for someone else. |

|

|

|

|

#53 (permalink) |

|

Young Crumudgeon

Location: Canada

|

Wait... did you just Godwin taxes?

... Okay, I'll take a crack at that one. Imagine that you and your buddies all got together and formed a club. Maybe you decided that you all like top hats and wanted a Top Hat Appreciation Society. Whatever. Your club grows until you have, say, 100 members. You're getting tired of the guys coming around every Wednesday, messing up your basement and drinking all your beer. So you decide to take a vote. The vote passes -- you'll rent a club house. The kitchen will be full of snacks, the fridge always stocked. Hell, go all out. Get one with a bar and keep your favourite brew on tap. But all of those things cost money, and that's a problem. So you decide that you'll take up a collection. Maybe you decide that everyone chips in the same amount, or maybe Joe rakes in the bank as a lawyer and Fred barely makes ends meet as a high school janitor, so Joe agrees to pay some of Fred's share. The details don't really matter; the important part is that you work out a system where the bills all get paid and everyone agrees that it's fair. And then there's Pete. Pete comes by the club house every week. He drinks the beer and eats the food, he watches the big screen high def tv, he uses the internet, and generally enjoys everything the club has to offer. But when it comes time to pony up the dough, Pete decides he's not going to pay his share. So what do you do? Well, the logical answer is to kick Pete out of the club. But maybe there's a clause in the club's charter that once a member is vetted, they stay a member for life. You can try to amend the charter, or you can just change the locks so that Pete's club house key doesn't work anymore and he can't abuse the place that everyone has worked so hard to make great. ... A democratic nation when viewed at the most basic level could be considered an agreement between a collection of people. Those people generally live within a geographically contiguous area, and sometimes people get confused and think it's the geography that makes the nation, but it's not. The people agree to work together for their collective betterment, and as part of that agreement they all chip in to pay the costs of services they agree are essential. You could make the argument that you didn't choose to be a citizen of your nation, and that would be fair. Unless you immigrated, that status was granted automatically and irrevocably when you were born. However, you choose to remain a citizen; you choose to continue to live where you are, and take advantages of the services offered. If you really have a problem with taxes, you should optimally cease to do so. Go live out in the wilderness, eat what you catch, make your own clothes, etc. If you don't choose to do that, you're Pete. Don't be surprised when the other members of the club tell you to pay up or get out.

__________________

I wake up in the morning more tired than before I slept I get through cryin' and I'm sadder than before I wept I get through thinkin' now, and the thoughts have left my head I get through speakin' and I can't remember, not a word that I said - Ben Harper, Show Me A Little Shame |

|

|

|

|

#54 (permalink) | |

|

Junkie

|

Quote:

maybe you keep getting "oh not again" everytime you say that because people are tired of an overly simplistic, inaccurate analogy? the government isn't robbing you at gunpoint. there is a cost to living in an ordered, organized society. you may not like everything your tax money goes to, but as long as you choose to live within the boundaries of any modern society, expect to have to follow the social contract and pay the costs associated with having the services and benefits of society available to you (paved roads, police, fire fighters, etc). don't expect to get all the benefits of living amongst the rest of us without having to pay your fair share (although, what one's fair share is open to debate).

__________________

shabbat shalom, mother fucker! - the hebrew hammer |

|

|

|

|

|

#56 (permalink) | |||

|

Junkie

|

Martian: A good analogy, except that this is a "club" which one is not permitted to leave. The US is one of fewer than half a dozen nations which tax income earned outside of its' borders, and expatriating from the US in order not to support imperial wars of aggression (for instance) is a Felony, even if the expat in question has renounced their US Citizenship.

Harry; permit me to respond to your post in detail. Quote:

Quote:

Quote:

|

|||

|

|

|

|

#58 (permalink) | |

|

Junkie

Location: bedford, tx

|

really? try refusing to pay.

Quote:

__________________

"no amount of force can control a free man, a man whose mind is free. No, not the rack, not fission bombs, not anything. You cannot conquer a free man; the most you can do is kill him." |

|

|

|

|

|

#59 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

What does the federal government provide to a rich man that it does not provide to a poor man?

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#60 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

For starters, national security. The rich have more to be protected than the poor. There is also diplomacy and foreign military actions to protect American "interests," which involve large multinational corporations, and therefore its shareholders, mostly rich. There is also "corporate welfare." We also have the FDIC, the FED and other agencies that protect financial assets (and the rich have more to be protected than the poor) and establish financial stability even if at the cost of employment (this at least since the 70s, thus helping capital over labor). And let's not forget subsidized cutting edge medical research, most of which, though developed with public funds, take decades to be made affordable to the average person. Oh, and while many of the things Derwood said are indeed local and state level services, a significant chunk of them are subsidized by the federal government . And finally you have the subsidies. You have the farm subsidies and tariffs, for example, which are, more than anything else, an almost direct redistribution of income from the poor (since food is a bigger item in their budget) to farmers. Obama tried to limit the subsidies to farms which make less than 500,000 dollars a year and was soundly defeated. But I digress. This whole discussion about the state has been so historically decontextualized that it is hard to make the discussion serious enough. If you look at how the state came about, and how things would be right now if the state was completely abolished, it is impossible to adopt this "poor rich man" routine. |

|

|

|

|

|

#61 (permalink) |

|

Junkie

Location: NYC

|

Dippin, your graphs are beside the point. I dind't say the rich are paying higher marginal rates now, I said that the progressivity of the taxes actually paid is higher now than at any time in history. and it's absolutely the case that more of the total tax burden is borne by the rich today than ever was the case in history. That's progressivity. Increasing the share of taxes paid by the rich will aggravate a situation in which you have a citizenry divided into those who benefit from govt without paying much if anything for it, and those who do pay. It's not healthy for society to create a class of moochers and then expect others to pay for it. That'll work to some extent if the tax burden isn't that big, but watch what happens when you raise it.

Your complaint is that the rich have more money to begin with. Well, yes, that's a tautology. It's also why they'd pay more taxes even with a flat tax. But that has nothing to do with progressivity. |

|

|

|

|

#62 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Progressive taxation is not the rich paying more. It is the rich paying more in proportion to their income. And what all those graphs show is precisely that. The share of their income the rich pay in taxes is at its lowest point in over half a century. The fact that the rich pay a higher share of the total taxes right now is explained by the fact that they have a much higher share of income. Even with linear taxation that would be the same. Edit: And I think you read the graphs wrong. Only the first one is the effective tax rate. The rest are the share of income paid in taxes. Last edited by dippin; 12-16-2009 at 04:38 PM.. |

|

|

|

|

|

#63 (permalink) |

|

Junkie

Location: NYC

|

Progressivity means that marginal income is taxed marginally more. It looks at the rate on each additional dollar of income.

But your point appears to be that high earners (however defined - definition is an issue, too) tend to find ways to keep their total income tax down. Yeah, they do. They do it mainly by time-shifting and because much of their income is in capital gains. If you take out the capital gains piece, I would bet that the graph would show a huge amount of progressivity by your definition. is your complaint that capital gains have differential treatment? Or is your complaint that it's not right for people to make a lot of money? You do realize that the best way to avoid paying tax on capital gains is not to sell, don't you? Introducing illiquidity by constricting the number of sellers and buyers has consequences. You might be willing to pay those consequences, but please show that you considered any of this stuff beyond simply stamping your feet about the fact that some people are doing better than you. ---------- Post added at 04:20 AM ---------- Previous post was at 04:14 AM ---------- Oh, and I should add that increasing marginal rates at the top means (ceteris parabus) more of the tax burden gets borne there. You might like that result, but again, there are tradeoffs. And one of them is that there tends to be less income at that level. The compensation tends to get diverted to untaxed, lower-taxed or deferred-taxed activities. |

|

|

|

|

#64 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

that taxes were more significantly more progressive before and there weren't any of the destructive effects you seemed to proclaim. And taxes were significantly more progressive before by any standard you'd like to measure, be them the effective tax rates, nominal tax rates, or tax as a share of individual income, etc. |

|

|

|

|

|

#65 (permalink) |

|

Junkie

Location: NYC

|

No, dippin, they weren't. Federal income taxes consistently have come in at a rate of between about 18.5 and 21.5% of GDP, and have been for years. And they have stayed there no matter what the rates were. (Ace posted the graph on this a while ago, but it's no big secret.) People who can figure out ways to save taxes do so. My tax partner would be out of business otherwise. You'd be amazed at the things people do (legally) to avoid being taxed. They defer income, they lock up funds in illiquid investments, they invest in cockeyed schemes, they hold assets that economically they should sell, etc etc etc. The tax system is massively distortive, and if you think raising rates cures the distortion you're sadly mistaken.

What we do know about capital gains taxes is that cutting them tends to stimulate gain-taking. That's been borne out by every cut in history. Plus, dippin, what your'e claiming is massively counterintuitive. Let me ask you something: if you were being taxed at 25%, and the next year you were told that if you keep doing exactly the same thing you'd be taxed at 40%, what would you do? If you're like any other person with a particle of sense you'd figure out ways not to do the same thing and try to set things up so that you don't have to fork over more of your income. This is simple common sense. This idea you seem to have that people in a different income bracket than you would react differently to incentives than you would is very curious. If anything, the fact they're more successful seems to indicate they have incentives figured out better than you do. |

|

|

|

|

#66 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Saying something isn't so doesn't actually make it so. Other than that, I have no clue what to say other than it is pretty well established that the rich paid a greater share of their income in taxes before than they do now. By the way, federal income taxes have not consistently come in at 18 to 21 % of GDP. That is actually TOTAL federal taxes, which also include payroll and excise taxes. But how that relates to how progressive taxes are is beyond me. |

|

|

|

|

|

#67 (permalink) |

|

Junkie

Location: NYC

|

Dippin, if total tax burden is consistent across time, irrespective of variations in rates across time, that tells you that overall payment of taxes is resistant to more than marginal attempts to increase them.

And you really serious think that people don't respond to tax incentives? Is that really your position: that taxes can be raised without affecting the behavior of the people who are taxed? If it is, well, wow............. The problem with your argument in general is the counterfactual: what would the economy have looked like in the 1950s, say, with lower tax rates? What we do know, however, is that when JFK slashed rates the economy boomed. JFK did the first supply side tax cut and it was massively successful. It also raised much more tax money than before. You can look it up. You also might want to look at the history of tax shelters. I'm not making this stuff up, I've seen it come and go through my career in dealing with clients who are businesses. (i.e. I have real life experience with this stuff, not graphs out of a book that other people put together to grind political axes with). |

|

|

|

|

#68 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Oh, and whatever stability there seems to be in total federal revenues, that leaves out state and local taxes, where the number fluctuates a lot more, but is still completely beside the point related to how progressive taxes are. And I would love to see where I said that taxes do not affect the behavior of the people taxed. You seem to be having a conversation where parts of it take place entirely within your head. All I've said is that taxes were significantly more progressive in the past without any of the disastrous effects you claimed there would be. Last edited by dippin; 12-17-2009 at 07:41 PM.. |

|

|

|

|

|

#69 (permalink) | ||

|

Junkie

Location: Ventura County

|

We can agree on the above, but I think for different reasons. If you measure "better" in terms of monetary measures ( as opposed to other measures - i.e. my grandmother lived in a 3 room house in rural Arkansas without an indoor bathroom until 1966, but was the happiest person I have ever known - I visited her in that house as a kid and loved every minute of it with the exception of the mosquitoes at night, they really seem to enjoy "city" blood ) "rich" people will have the biggest improvements in absolute terms when the economy grows. But they are also the biggest losers in absolute terms when the economy shrinks. So, in a weird way you can pretend you support economic growth and pretend that you want everyone to participate equally, but that is pure fantasy. What I want, and what I think you fail to understand, is for poor people to have the opportunity to get "rich", or at least have the financial security to own things like their home, be able to pay for their children's education, retire without a drop in living standard, and to leave a little something for their heirs after paying for the funeral, all without having to worry about government programs.

The Bush tax cuts did more for giving poor and middle class the opportunity to get "rich" than you seem to be willing to acknowledge. In order for a poor or middle class person to get rich they have to be able to keep more of the money they earn and then put that money to work through investments. Very few, percentage wise, get rich solely through the wages they earn from working for others. The "system" works against a person getting "rich" through the normal 9-5, corporate, wage earner routine. ---------- Post added at 07:25 PM ---------- Previous post was at 07:10 PM ---------- Quote:

However, "rich" are generally people who own resources that generate income or capital appreciation. They usually file something more than the 1040EZ. There are "rich" politicians and "rich" activists, you know like Jessie Jackson or Ralph Nader. I won't put my speculations in writing on how they got "rich", but I acknowledge they are not "small business owners". People like Paris Hilton and descendants of Joe Kennedy are not small business owners either but are "rich". And then we have people like, oh, everyone who plays for the Yankees, are not small business owners. ---------- Post added at 07:34 PM ---------- Previous post was at 07:25 PM ---------- Quote:

P.s. - We are not accepting anymore people from California or New York in North Carolina.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||

|

|

|

|

#70 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

|

|

|

|

|

|

#72 (permalink) | ||

|

Junkie

Location: Ventura County

|

Quote:

If a guy making $100,000 nearly doubles his income to $195,000, on an absolute basis and a proportional basis he did not do as well as Bill Gates but somehow I think the guy at $100,000 would actually "feel" the value in his increase in income, some on some subjective level I could argue that he did "better". Our progressive income tax system actually hurts the guy at $100,000, but has no impact on a guy like Bill Gates. This concept forms the basis of my view on tax policy. Our tax policy does not affect people with great wealth, it impacts people trying to earn income, the income needed to get "rich". The difference is perhaps subtle, but there is a difference. Our income tax system also hurts the single mom getting the earned income tax credit as well, if she has the opportunity to earn a little more income she could face a large marginal tax increase - her biggest incentive is to stay poor, unless she pulls something off like winning the lottery. ---------- Post added at 10:11 PM ---------- Previous post was at 10:00 PM ---------- Quote:

Bill Gates could zero out his "income" ( income as defined by the IRS, not capital gains - and actually Bill Gate could take loans on the value of his assets and never have to realize taxable capital gains) but still live like a billionaire for the rest of his life and the lives of all of his descendants based on our tax system.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." Last edited by aceventura3; 12-21-2009 at 02:14 PM.. |

||

|

|

|

|

#74 (permalink) |

|

Crazy, indeed

Location: the ether

|

The funny thing about proponents of a flat tax or even of consumption tax is that most of them believe that they would pay less taxes if that system was approved. Even just to maintain current revenue levels (which still leave behind a huge deficit), everyone except the richest 5% or so would see a very large increase in how much they pay in taxes.

|

|

|

|

|

#75 (permalink) | |

|

Junkie

Location: Ventura County

|

It depends on how you structure the tax. For example, we could exclude taxation on a family's first $25,000 of consumption. We could exclude taxation on food, shelter, day care, clothing, medicine.

With our current tax structure they get so creative that it takes experts to fully understand the tax code (and those experts really know how to exploit the tax code - without breaking the law), I would argue for simplicity but we could apply some creativity to not overly burden poor people. And I would really love for the folks in the "underground" economy pay their fair share. ---------- Post added at 05:19 PM ---------- Previous post was at 05:02 PM ---------- Quote:

For example, and I don't know if it is still true, but at one point if you purchased a vehicle with a weight of over 6,000 pounds (big SUV's, trucks, etc.) used for business you could take a deduction for the value of the vehicle in a single year, but you could not do that for a fuel efficient car. So, back in the 90's when everyone was buying big SUV's, many did so simply because of the tax advantages. In my view if you use a vehicle for business they all should be treated the same way. Our current tax code is loaded with this kind of stuff, the "rich" take advantage of it, most everyone else can not. Another example involves year-end tax planning that most of us have to do: Did you use the money in your pretax medical account? Did you put in the correct amount in your IRA/401(k)? Do you need to defer income to avoid the loss of a tax credit? Do you need to buy tools to hit the minimum for your misc. deduction? Do you get divorced before the end of the year or wait until next year? Do you induce labor on New Years eve, or wait? It gets crazy.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

|

#76 (permalink) | |

|

Who You Crappin?

Location: Everywhere and Nowhere

|

Quote:

which gets right back to the anger about "poor people don't pay taxes" and "there is no incentive for poor people to better themselves" nonsense |

|

|

|

|

|

#77 (permalink) |

|

Junkie

Location: NYC

|

actually, no. If everyone benefitted from the consumption exemption, there's no issue.

Not that I'm a huge fan of consumption taxes. I would set up a system that has diff tax schemes, including income, consumption and excise, but keep the rates in all of them low enough not to distort anyone's economic decisionmaking. |

|

|

| Tags |

| bush, cuts, latest, rich, tax |

|

|