|

|

|

#1 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Financial Company Deadpool

Many are watching this from the sidelines, not knowing what to say or do, but worrying about the future.

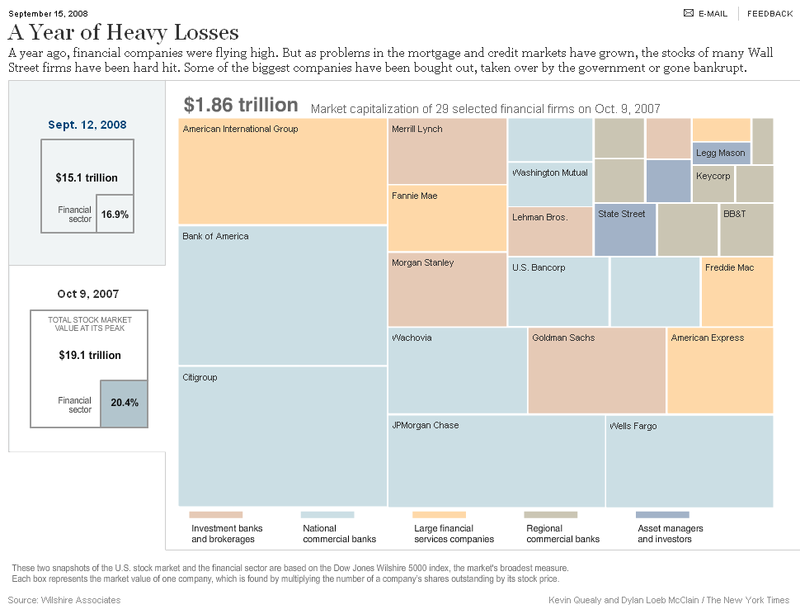

Some of us are in Politics talking about what is going on, if you'd like to discuss it a bit more in depth, bring it on, we're happy to have more people in there: http://www.tfproject.org/tfp/tilted-...round-2-a.html But this thread is strictly a deadpool type discussion. Who do you think is next?  This link can give a bit more insight as to what the valuation of the companies were in Oct 2007 vs. Sept 2008. A Year of Heavy Losses - Interactive Graphic - NYTimes.com Citigroup already wrote down their books earlier this year. I'm not convinced that they went far enough, so I'm taking them to 3rd position. I think that Washington Mutual is announcement that comes out in a few weeks as they were heavy into the mortgage business during the growth years, and Wachovia next for the same reasons. 1. WaMu 2. Wachovia 3. Citigroup

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#2 (permalink) |

|

All important elusive independent swing voter...

Location: People's Republic of KKKalifornia

|

I think WaMu is in merger discussions now. It does seem like a line of dominoes and a chain reaction. I just wonder where it will stop and the consequences. Will we be leaner and more efficient or saddled with debt and a crippled economy?

__________________

"The race is not always to the swift, nor battle to the strong, but to the one that endures to the end." "Demand more from yourself, more than anyone else could ever ask!" - My recruiter |

|

|

|

|

#3 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

Every indication is that WaMu will find a merger partner/buyer.

Until last night, I thoughht AIG was going down with mixed emotions (major trading partner but also major competition). I now question who will be allowed to fail. But in th e spirit of the thread: CNA Citi GM

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#4 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

GM because of GMAC or because of the automotive part? I didn't even think of their DiTech holdings, didn't they shed those long ago?

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#5 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

GM has so many, many problems.... But the fact that they're not selling many cars now and the ones that they do sell have lower profit margins than their SUV's means that they've got a potential killer on their hands.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#7 (permalink) |

|

Registered User

|

AIG could have prevented this from happening to this degree. And the SEC should have some sort of protection against a Bear Raid .. there is talk about the SEC changing the short sell rules which is what killed these companies. I knew AIG would be bailed out simply because it was a sovreign company and if it went down it would mean major disaster for other financial institutions. Think about it, they insure the debt of alot of banks..they go down more banks go down.

Anyway, I don't see the feds letting GM go down the tubes. If anything, they'll get similar deal that AIG received. I'm actually looking to Citi for the next big fallout.. but who knows.. it could be a complete surprise. |

|

|

|

|

#8 (permalink) |

|

Super Moderator

Location: essex ma

|

morgan stanley is talking with the china investment corporation.

i wouldn't be surprised if american chauvinism kicks in sooner rather than later and undoes this. if that happens, morgan stanley could well be next. wachovia's shares fell 22% this morning too. lots of options.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#9 (permalink) |

|

Registered User

|

Looks like right now the big three in the watch pool are Morgan Stanley, WaMu and Goldman Sachs.. WaMu and Morgan Stanley rallied a bit today but Sachs still closed 6% lower.

Also looks like we may have a new Resolution Trust Corp. to soak up some bad loans and debt.. not sure how I feel about that one yet. |

|

|

|

|

#10 (permalink) |

|

All important elusive independent swing voter...

Location: People's Republic of KKKalifornia

|

How's CitiCorp/Group? They're still vulnerable I think.

__________________

"The race is not always to the swift, nor battle to the strong, but to the one that endures to the end." "Demand more from yourself, more than anyone else could ever ask!" - My recruiter |

|

|

|

|

#11 (permalink) |

|

Wehret Den Anfängen!

Location: Ontario, Canada

|

Did AIG count as a fall, given that it lost 80% of shareholder equity overnight.... Ie, how much shareholder equity has to be lost for it to be a fall?

Do they have to default on any loans for it to be a fall?

__________________

Last edited by JHVH : 10-29-4004 BC at 09:00 PM. Reason: Time for a rest. |

|

|

|

|

#12 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

I don't think that they count. You have to file bankruptcy.

That said, I still have very mixed feelings over the bailout was a good thing or a bad thing.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#13 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#14 (permalink) |

|

Registered User

|

I found it rather strange that the Government bought WaMu then sold it to JPMorgan. It's a little bit scary honestly. It's like the government controlling the private sector.. if this continues (yes I know these are unique times) it could only spell disaster.

|

|

|

|

|

#15 (permalink) |

|

Super Moderator

Location: essex ma

|

that happened while mc-cain was getting whacked by the far right yesterday afternoon...such theater. better than a mini-series.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#17 (permalink) |

|

All important elusive independent swing voter...

Location: People's Republic of KKKalifornia

|

Why didn't Chase just buy directly from WaMu? Why did the gov't have to get involved at all?

-----Added 26/9/2008 at 05 : 56 : 22----- Next how? To fall? To be bought by Chase? To be bought by the Gov't? What are the details? This is good, like a purge or cleansing. We'll be better for it.

__________________

"The race is not always to the swift, nor battle to the strong, but to the one that endures to the end." "Demand more from yourself, more than anyone else could ever ask!" - My recruiter Last edited by jorgelito; 09-26-2008 at 01:56 PM.. Reason: Automerged Doublepost |

|

|

|

|

#18 (permalink) |

|

Super Moderator

Location: essex ma

|

Confidence in US banks nosedives after Washington Mutual collapse | Business | guardian.co.uk

i put this link somewhere---i thought it was here. sorry about that. this outlines the situation with wachovia this afternoon. curiously under-reported so far in the press is gordon brown's idea of creating a transnational regulatory instrument of some type that'd be in a position to meaningfully regulate global financial flows. that makes some sense--one thing this is demonstrating is that nation-states are at the very limits of their abilities to manage this sort of problem--so either there are restrictions placed on the types of transactions which are permissable that are much tighter than there are presently, or the period of the nation-state will inch a little closer to being quaint.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#19 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

interesting now that Citi is being "bailed out"

why is it that we can't just let something FAIL. Seriously? If kids don't pass, they don't pass, they FAIL. If a company doesn't succeed, they FAIL. It's pretty simple.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#21 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

This has happened in the 90s with many banks after the S&L crisis of the 80s.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#22 (permalink) | |

|

Wehret Den Anfängen!

Location: Ontario, Canada

|

Quote:

And that, thanks to banks being overly trusting of ratings agencies, many many banks ended up being upside down.

__________________

Last edited by JHVH : 10-29-4004 BC at 09:00 PM. Reason: Time for a rest. |

|

|

|

|

|

#23 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

yes, I do realize that, this situation doesn't mean that HSBC, RBS, or other foreign banks, cannot purchase the debts and assume the operatoins of the banks here.

This belief is the same that I have for the automotive industry. The system will not fail completely which is what we witnessed in the 30s because there are outsiders that do have capital to purchase the outstanding companies and debts.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#24 (permalink) |

|

Wehret Den Anfängen!

Location: Ontario, Canada

|

Are you ok with the Chinese government owning most US banks? They have the capital, if they want to risk it.

An otherwise solvent bank can become insolvent if enough other banks go under, because of their mutual obligations and hedgings. When a bank goes bankrupt, trade locks up -- accounts cannot be accessed, etc. The debts the bank owns can be sold, but selling them _quickly_ will cost a pretty penny, and in a cash-poor situation even selling them slowly will probably not be enough to cover depositors. The fear of banks going bankrupt leads to people pulling cash out of banks and into safer options. Even if your bank is doing fine, proving this is hard -- so your cost of credit goes way up. Which means your investments which where fine are now costing you money, and your balance sheet starts getting worse. Until you are upside down, and if you _do_ tell people the state of your finances, they would pull their money out. This wasn't just a domestic problem. Banks around the world bought up US securities that where backed by the credit of various US banks, under the assumption that they where top-tier quality debt. Drop the quality of that debt, the value of that debt drops, and the banks end up being ... upside down, with balance sheets that do not show positive net worth. In order for someone to buy them out, that someone has to has to _want_ those balance sheets, and have enough raw cash to _pay_ for the difference in value. And everyone's balance sheet got squeezed by the increase in cost of credit, so I seriously doubt that all of the 'sound' banks have enough $ floating around. All of this encourages people to take cash, and not invest it in a way that allows for automatic re-investment (which makes some sense, as the automatic re-investment that you engage in when you have cash in a savings account ... turns out it wasn't returning all that good returns).

__________________

Last edited by JHVH : 10-29-4004 BC at 09:00 PM. Reason: Time for a rest. |

|

|

|

|

#25 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

The Chinese actually don't have the capital and solvency to purchase based on the ties they currently have with a mutually assured destruction based on US/Foreign owned factories that are the basis of their capital. They too are on shaky ground.

I do understand that someone has to want those balance sheets. The part that you're forgetting is that US banks are currently picking up those balance sheets by government intervention. They are picking up that bad balance sheet with pennies on the dollar. So what makes this different? As far as people using cash, well the Chinese are king with that. Walk in your local Chinatown and see just how many of the small businesses take credit cards. You'll find that the ones that do are restaurants...anything else that does, knows that they don't have much of a choice, but will always give a cash discount to the buyer because they don't want to pay those pesky credit fees.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#26 (permalink) |

|

Wehret Den Anfängen!

Location: Ontario, Canada

|

The Chinese government has lots of US cash they frantically turn into US treasury bonds.

But turning it into any US asset has a somewhat similar effect, with regards to the currency balance between the two nations. An issue is that the Chinese have been burned more than once when they invested in individual companies. But the liquidity to buy US corporations? They have a fire hose of US dollar liquidity.

__________________

Last edited by JHVH : 10-29-4004 BC at 09:00 PM. Reason: Time for a rest. |

|

|

|

|

#27 (permalink) |

|

Nothing

|

This is only just beginning (lots more mortgages start resetting and revaluing(i forget the proper term, but there were many mortgages with portions of the principle suspended for a period of time) next year, plus commercial real estate is starting to show its distress, plus, plus, plus).

What are my odds on a bet of "All of the above"? Until the US Gov runs out of capacity to borrow from foreigners and the currency becomes.. well... less than respectable, which it will in time (watch out for the popping of the bond bubble soon/soonish and the commensurate collapse in the dollar), they won't allow any major financial institution to fail. The reason being the Credit Default Swaps that are out there, running into many 10/100's of trillions, depending on who you listen to, that would be affected or triggered... and the problems with counter-party risk. Lehman almost brought Armageddon... and it was, if memory serves, the smallest of the 'big' investment banks. Also, should another large bank be allowed to fail, the money markets will break the buck again and then the credit markets will shut down completely. Again (they're still shut down for any but the highest credit-rated corporations on commercial paper, for example). Trying to unfreeze that loss of confidence in what now laughably passes for 'the system' well... good luck with that. The UK is in even worse condition. The pound is dead first, then comes the dollar. Financial meltdown of the Anglo-Saxon model... -----Added 4/12/2008 at 11 : 58 : 29----- Yakk: You're right. At current prices, if the US gov allowed them, many of the Sovereign Wealth Funds could walk in and buy pretty much all of corporate America overnight. Why they're not even seemingly interested in doing that is interesting.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- Last edited by tisonlyi; 12-04-2008 at 08:58 AM.. Reason: Automerged Doublepost |

|

|

| Tags |

| deadpool, financial |

|

|