|

|

|

#1 (permalink) |

|

Junkie

Location: New York

|

Cash for clunker appliances

The article below describes the latest installment of Obama's bailout is to provide rebates for old appliances.

Just how many of these 'incentives' and 'stimuli' do we need at taxpayer expense? Why should the government be in the business of artificially stimulating (or penalizing) the economy for any reason at all? What happens to retailers after this artificial spike in demand? Do we have another bailout in January because appliance sales have fallen to even lower levels? So once again, the taxpayers get the shaft, having to pay for yet another government giveaway. 2010 and 2012 can't come soon enough for me to cast my vote to get these guys out of office. I'm tired of the government taking my money away from me for stupid stuff like this. 'Clunker' appliance plan short on details - Retail - msnbc.com Call it the “Cash for Kitchen (and laundry room) Clunkers” program. If you have an old energy-guzzling refrigerator, air conditioner or washing machine you’d love to replace, it may be a good idea to wait until November when a cash-for-clunkers type program for home appliances begins to roll out across the country. The rebate program, part of the government's $787 billion economic stimulus package, provides $300 million in federal funds to encourage consumers to buy energy-efficient appliances. But it is unclear how much the appliance program will save in terms of energy consumption — and whether these appliances will be recycled or just end up in a landfill. And unlike the hugely successful $3 billion “Cash for Clunkers” vehicle trade-in program, the appliance rebates will be handed out under a hodgepodge of plans implemented by individual states, with the money divvied up according to each state's population. Consumers will be eligible for a rebate only if they buy products that meet federal Energy Star qualifications for appliance efficiency. Rebates under the program could range from $50 to $250, depending on the type of appliance. States have until mid-October to come up with their own plans for how the rebate programs will work, what appliances will be included, how much will be paid out and even how to dispose of the "clunkers." While there is no recycling requirement, the Department of Energy “is encouraging states and territories to include appliance-recycling programs along with the rebate programs to help remove inefficient products from the electric grid,” said Jen Stutsman, a spokeswoman for the department. |

|

|

|

|

#3 (permalink) |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

The government has added about $1T of cash into the system. Hyperinflation is inevitable without taking that money back out. These plans continue to add money into the system, so clearly this administration is responsible for any eventual consequences.

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

#4 (permalink) | |

|

Junkie

Location: New York

|

Quote:

In the meantime, the taxpayer is stuck with at least a $1.5 trillion dollar bill for government meddling and what the government thinks will result in an economic recovery. So we end up with a government that is wasting money on things like this and not thinking about what happens after the phony incentives end. |

|

|

|

|

|

#5 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#6 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

If anything, the problem is that the dollar has not been devalued enough, given the exchange account deficits. |

|

|

|

|

|

#7 (permalink) | |

|

WHEEEE! Whee! Whee! WHEEEE!

Location: Southern Illinois

|

Quote:

__________________

AZIZ! LIGHT! |

|

|

|

|

|

#8 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

http://research.stlouisfed.org/fred2/graph/?s[1][id]=AMBNS http://en.wikipedia.org/wiki/Money_supply

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." Last edited by Cimarron29414; 09-24-2009 at 10:54 AM.. |

|

|

|

|

|

#9 (permalink) | ||

|

Crazy, indeed

Location: the ether

|

Quote:

The S&L crisis is one example of a crisis that required a bail out. By the way, there seems to be rampant confusion between bail out and stimulus package. The bail out, which was the rescue of troubled financial institutions, has so far turned out to be a money maker for the federal government. It has not been unprecedented or new. The stimulus package, on the other hand, is the spending and tax cuts used to stimulate the economy. It was not new or unprecedented either. In fact, I am surprised that so many are willing to include tax cuts as part of the cost of the total stimulus package, but forget to do so with Bush's stimulus package. As a percentage of GDP, neither the deficit nor the debt are unprecedented. Nor is the amount of money circulating. ---------- Post added at 11:12 AM ---------- Previous post was at 10:53 AM ---------- Quote:

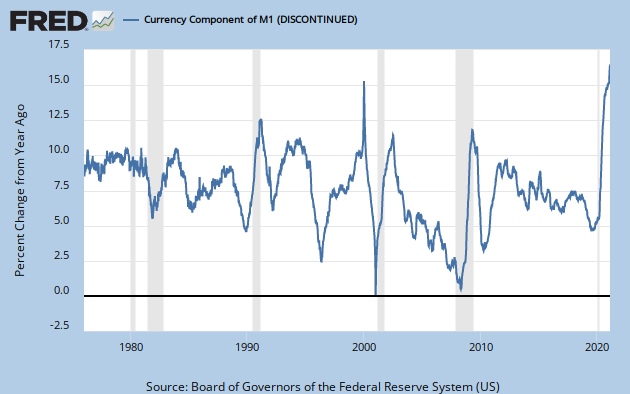

Of course, money in circulation by itself is a meaningless measure. More important is the velocity of circulation:  which is also nowhere near unusual levels. Current economic debates need a lot more information and a lot less hysteria. |

||

|

|

|

|

#10 (permalink) |

|

Location: Washington DC

|

In fact, Bush/Republican 2005 enegy bill authorized that same $300 billion for these same home appliance rebates.

It was one of those provisions that Bush agreed to include in the bill to get bi-partisan support, then chose not to include funding for the program in his last two budgets, reneging on the deal. And, as part of that same act, incandescent light bulb will be phased out in the U.S. starting in 2012.

__________________

"The perfect is the enemy of the good." ~ Voltaire Last edited by dc_dux; 09-24-2009 at 01:52 PM.. |

|

|

|

|

#11 (permalink) | |

|

WHEEEE! Whee! Whee! WHEEEE!

Location: Southern Illinois

|

Quote:

__________________

AZIZ! LIGHT! |

|

|

|

|

|

#14 (permalink) | ||||||

|

Junkie

Location: New York

|

Quote:

Actually, it was $300 million, and was, as you point out, never funded, so net cost to the taxpayers for that was $0.00. Why does what Bush did or didn't do make Obama's rebate any more appropriate? The government shouldn't be doing things like this at all at least until it gets it's finances under control. This is just another instance of taking money we don't have (borrowing) from the taxpayers for another government giveaway. ---------- Post added at 07:05 PM ---------- Previous post was at 07:04 PM ---------- Quote:

---------- Post added at 07:28 PM ---------- Previous post was at 07:05 PM ---------- Quote:

Quote:

Besides which, the government shouldn't be in the business or running profit-making enterprises either. Quote:

Quote:

US Federal Debt As Percent Of GDP in United States 1792-2010 - Federal State Local[/quote] |

||||||

|

|

|

|

#16 (permalink) | |

|

Junkie

Location: New York

|

Quote:

I find it very hard to believe that any president can raise spending drastically and either not blow the federal debt thru the ceiling or raise taxes. Accounting just doesn't work that way. Since Obama has promised to shrink the deficit, that leaves increasing taxes. |

|

|

|

|

|

#17 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Nothing I said was meant to defend Obama or attack Bush. The point remains that neither deficits nor debt are at all time highs. And while that graph you showed is technically correct, about 30.4% of that debt is actually held by the government itself. The debt that matters, in terms of repayment, is the debt held by the public. And that, while increasing, should reach about 59.9% of GDP this year, a little more than half what it was in 1946. And you want to know why the debt and the deficit are increasing? Because tax receipts as a percentage of GDP will be at their lowest point since 1950. So I think its funny how people are so bent out of shape about their tax money, when in fact they are paying the least taxes in a generation. The bail out and stimulus money are drops in the bucket, and the real long term issue regarding the deficits is that people complain so much about their taxes and yet want their medicare, their social security and their military in place. Data found on Budget of the United States Government: Historical Tables Fiscal Year 2010 |

|

|

|

|

|

#18 (permalink) |

|

Psycho

|

Why should I (through my taxes) continue to pay for things like this? I did not like the "cash for clunkers" idea either. Why should I pay for my neighbor's new car because he chose to drive what he drove?

But more to the point - I live in an apartment complex. If the owner decides to replace all of the appliances - he gets a rebate. I get a month's, or even a week's free rent? Don't friggin' bet on it. |

|

|

| Tags |

| appliances, cash, clunker |

|

|