Quote:

Originally Posted by dogzilla

I've worked thru something like five recessions, back to 1974. I don't recall any of those recessions requiring a bailout like this, and the economy recovered from each one of them. With or without any bailouts, this recession will end as well. Eventually, as a consumer, I will need to buy a new car, a new refrigerator, new TV, etc, all in due time.

In the meantime, the taxpayer is stuck with at least a $1.5 trillion dollar bill for government meddling and what the government thinks will result in an economic recovery. So we end up with a government that is wasting money on things like this and not thinking about what happens after the phony incentives end.

|

You weren't paying attention, then.

The S&L crisis is one example of a crisis that required a bail out.

By the way, there seems to be rampant confusion between bail out and stimulus package.

The bail out, which was the rescue of troubled financial institutions, has so far turned out to be a money maker for the federal government. It has not been unprecedented or new.

The stimulus package, on the other hand, is the spending and tax cuts used to stimulate the economy. It was not new or unprecedented either. In fact, I am surprised that so many are willing to include tax cuts as part of the cost of the total stimulus package, but forget to do so with Bush's stimulus package.

As a percentage of GDP, neither the deficit nor the debt are unprecedented. Nor is the amount of money circulating.

---------- Post added at 11:12 AM ---------- Previous post was at 10:53 AM ----------

Quote:

Originally Posted by Cimarron29414

I'm talking printed money, not electronic money created through the sale of "debt" in the form of bonds. The actually money supply (printed plus electronic) has risen many trillions of dollars.

|

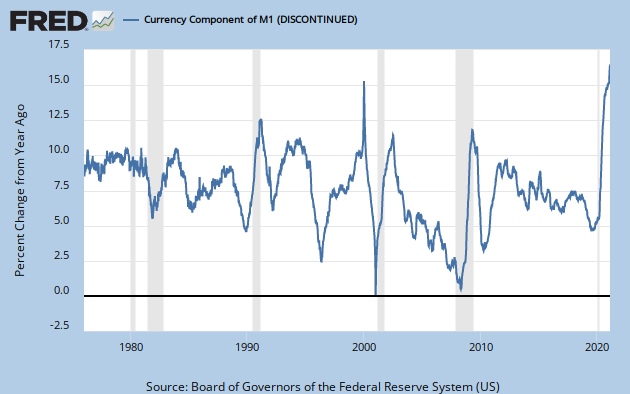

M1 in circulation always increases, and right now it is not increasing any faster than in past recessions:

Of course, money in circulation by itself is a meaningless measure. More important is the velocity of circulation:

which is also nowhere near unusual levels.

Current economic debates need a lot more information and a lot less hysteria.