|

|

|

#1 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

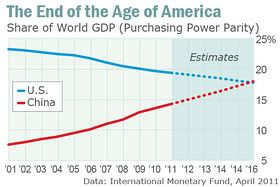

The Age of America near its end

Quote:

I must say that this is rather interesting. I suppose all of this comes down to metrics and how you measure economic influence, etc., but by this measure, I see that this is going to happen much sooner than I had expected. I have read a number of indications suggesting that China's economy is set to surpass the U.S. economy, but I thought it was much later down the road than five years; I thought it was more than ten or twelve.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

|

#2 (permalink) |

|

Tilted

Location: Iron Mountain

|

This guys whole thing is selling his stuff but I wonder if there isnt some truth to it. I have seen signs of us losing our currency status.

Stansberry's Investment Advisory |

|

|

|

|

#3 (permalink) |

|

immoral minority

Location: Back in Ohio

|

China has 4 times the people, and their money policies are better (fully regulated or unregulated don't work in the long run for the people). They are working harder, but not necessarily smarter. And even though they are using lots of polluting coal and gas now, their government can do stuff much faster than ours.

The problem I see is that China has expanded a little too fast. And they need to make sure the poorest people in the country keep up. I also don't know how long their factories will last if ocean shipping gets too expensive or if the employees get burnt out. Last edited by ASU2003; 05-08-2011 at 07:10 PM.. |

|

|

|

|

#4 (permalink) | |||

|

Location: Washington DC

|

Quote:

We've not focused on retooling the economy. Our govt investments in in R&D have been relatively flat over the last 10 years at the same time the private sector had greater incentives to make money by producing nothing (speculating on the market) than by being innovative. Here are a couple indicators: Quote:

Quote:

And now, we're faced with the tough decisions of spending on education, R&R, clean energy, health technology, etc. at a time when overall spending needs to be cut. We're in a deep hole as a result of our shortsightedness over the last 10 years and there wont be an easy way out.

__________________

"The perfect is the enemy of the good." ~ Voltaire Last edited by dc_dux; 05-08-2011 at 07:45 PM.. |

|||

|

|

|

|

#5 (permalink) | |

|

Future Bureaucrat

|

....Still waiting on Austerity measures. I wish politicians would be courageous enough to do what is necessary for this country (increased taxes, reduced benefits).

Our transportation infrastructure is overly invested in our highways, we have no genuine high speed rail, and even with our highways, we're not spending nearly enough to maintain or improve our highway infrastructure.

__________________

Quote:

|

|

|

|

|

|

#6 (permalink) | |

|

Location: Washington DC

|

Quote:

I should have included infrastructure investment, including broadband, with my list of necessary expenditures (R&D, clean energy, health technology...). A recent report from the Organization for International Investment documents the issue. U.S. Global Competiveness at Risk without Infrastructure Improvement, Report Finds There are numerous areas where we need to spend (govt investments) in order to compete globally, yet at the same time, need to address the mounting debt.

__________________

"The perfect is the enemy of the good." ~ Voltaire |

|

|

|

|

|

#7 (permalink) |

|

immoral minority

Location: Back in Ohio

|

America needs to clean up and regulate the financial industry with income limits on certain groups of people. We need to come up with a way to make clean energy cheaper than oil, coal, and gas. And we need to get people to live healthier lives.

|

|

|

|

|

#8 (permalink) |

|

Super Moderator

Location: essex ma

|

can you say national security state?

seriously, all this talk about austerity is meaningless unless/until something is done to begin dismantling the national-security state and reduce the obscene levels of spending the united states wastes on the military. but i agree basically with dc's post no. 4

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#9 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

I agree with post #4 as well, but it's useful to look at all the factors because it isn't a simple problem.

The video urville posted a link to is interesting in the issues/facts it raises—though its introduction is painfully verbose. Although I don't agree with it 100% regarding the angle/solutions, etc., it outlines some of the deep-seated problems within the American economy as it relates to expectations. For a while, I have been of the belief that there is a "correction" coming to the cost of living in the U.S. Despite what many Americans may think—of all classes—they still currently have it pretty good. Your gasoline prices are hitting "record highs" but are still 25% lower than in your oil-rich next door neighbour Canada. Food prices are cheap, mainly due to cheaply produced corn. Chinese imports and other imports from Asian nations (everything from clothes to computers) are cheap, cheap, cheap. But it's not going to last. Something's gotta give, and it's because of a number of factors. You can blame money printing, deficit spending, bloated military budgets, global inflation due to BRIC economic activity, etc., but to blame any one of these in isolation is naive. These are all going to cause the same problem: it's going to get pretty damn expensive in the U.S., and the fallout will extent beyond American borders. We are all going to be feeling the impact. The American way of life is not sustainable. It never was, and now it's coming to a point—as Jeff Rubin has been saying: Our world is about to get a whole lot smaller. Globalization as we know it is going to become unhinged. Unless we get some pretty high-tech solutions and fast (i.e. this will be nearly impossible), how the global economy operates will necessarily go through a massive shift away from open channels everywhere to localized/regional developments. The U.S. currency problem, the balance of trade problem, the debt problem: these are all symptoms of what's been true all along. We can't keep doing this.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#10 (permalink) |

|

Getting it.

Super Moderator

Location: Lion City

|

I was also reading an article this morning that suggested the US may lose its AAA rating. This sort of stuff is bad for the rest of the world as well.

__________________

"My hands are on fire. Hands are on fire. Ain't got no more time for all you charlatans and liars." - Old Man Luedecke |

|

|

|

|

#11 (permalink) | ||

|

Future Bureaucrat

|

Quote:

__________________

Quote:

|

||

|

|

|

|

#12 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

Military budget of the United States - Budget Breakdown for 2012 - Wikipedia, the free encyclopedia And the "net interest" proportion of the budget? Much of that is from military expenditures. National security debt. It's a killer.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

|

#13 (permalink) | |

|

Future Bureaucrat

|

Shrug. Sure, it costs lot of money to project military power across the globe. But medicaid, social security, and other welfare benefits cost a lot of money too. I think blaming the deficit on a 'national security state' is a vast overstatement.

Federal Spending Fiscal Year 2010  ---------- Post added at 11:11 AM ---------- Previous post was at 11:08 AM ---------- Latest figures show 118 boys born in China for every 100 girls, too. Combine that with a repressive government (which may be just as inept as ours) and a potential bubble, and China may not be as large of a threat everyone makes it out to be.

__________________

Quote:

|

|

|

|

|

|

#14 (permalink) | ||

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

Also, I would imagine that cuts to the military budget could run deeper before hitting detrimental effects compared to cuts to health care and social security. There are ways to reduce the costs of health care in the U.S. There is a huge potential for improvement there. I don't know enough about social security in the U.S., but when you start yanking too heavily on things like pensions, income security, and basic items such as food and shelter during a recession and shaky recovery, it's going to cause problems. If you think health care and social security need reform, then so be it. But when looking at annual budgets, hacking and slashing can have huge consequences. Quote:

How fucked up is that? The challenge for all of us is that China is a big wild card. There is little precedent for this. They're the opposite of America in a way. America went from a near free-market economy to a mixed economy during the industrial age and before the information age. China is going from a communist economy to a mixed economy during the globalized Internet age. It's difficult. But interesting.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot Last edited by Baraka_Guru; 05-11-2011 at 07:39 AM.. |

||

|

|

|

|

#15 (permalink) |

|

Super Moderator

Location: essex ma

|

typically. folk who for whatever perverse reason depend the bloated expenditures of the national-security state---to which you have to add the costs of 2 or 3 off-the-books wars----add social programs together in order to come up with a chunk of budget that offsets military expenditure.

the bottom line is that empire is expensive and the united states cannot afford it. that's the choice that's being avoided here.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

| Tags |

| age, america, end |

|

|