|

|

|

#1 (permalink) | |||

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Two years later: Dow up 37%, S&P up 46%

Although you might not see it on the street or hear about it from your neighbour or your friends and family, but there are strong signs that the American economy is entering a recovery cycle.

The Dow is up 37% and the S&P is up 46% since the end of 2008. This is after the worst of the recession. They still haven't hit their previous highs, but they're inching closer. Based on current trends, it could happen within a matter of months, and most likely before the end of 2011. Quote:

One way of measuring an economy is by tracing the consumption of resources, and, of course, oil is no exception. The American economy is expanding modestly and it's having an effect on oil prices. This isn't necessarily good news, considering high oil prices are one of the pressures placed on economic expansion; however, increased oil demand a sign that the economy is improving. Quote:

More: Quote:

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|||

|

|

|

|

#2 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

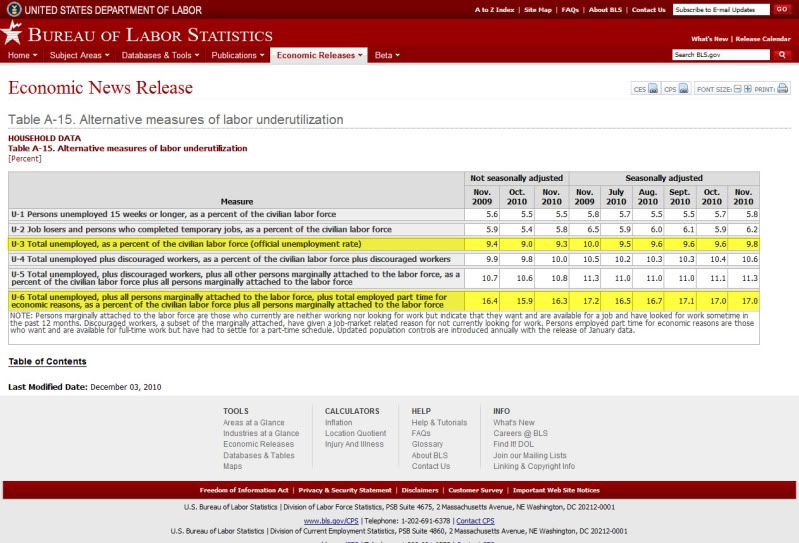

Call me a cynic but I don't see it based on the other indicators like order for durable goods, company debt to earnings, etc. and the U6 figures. Add to that the situations in Greece, Spain, Ireland, Iceland are all still not finalized and still problematic.

I believe this is all the same smoke and mirrors that got us into trouble before. U3 statistics aren't good enough in such a long cycle because many are now without benefits.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#3 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

I'll reiterate what I've said in other threads: employment numbers are a trailing indicator, markets are a leading indicator.

We'd have to look at a third set of indicators that are happening right now. Should we be looking at those instead of what is expected to happen in the future and what has resulted because of the past? The employment numbers are more a reflection of 2008/2009 than 2010. What about right now?

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#4 (permalink) |

|

immoral minority

Location: Back in Ohio

|

I made money in the stock market in the last two years. Not as much as if I bought the best stocks, but good enough.

I'm still not spending as much as I could, and the outlook for 2011 personally is trying to save even more money. Things like new cars or moving to a bigger house aren't important to me now. And I'm not sure if we will see any improvement in the housing sector in the areas that were hit hard by the speculators. I'm not sure if the home construction jobs will come back. And I don't believe that giving most people a few extra thousand dollars will change the economy, compared to the government paying down the debt and reducing spending with extra revenue coming in. If the US can't get foreign loans and runs out of money, all the lower tax rate stuff will be meaningless when the dollar loses it's value. And I still think that there are plenty of meaningless jobs out there. Companies could trim back and still get the same amount of work done. But that won't change. |

|

|

|

|

#6 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Regarding coincident indicators:

The above four points highlight what's going on in the economy right now, unlike what simply looking at unemployment numbers will do. If anything, looking at the above will help estimate what might happen with employment in the future. And on top of that you have recovering markets. What does this all add up to? How is any of this smoke and mirrors? With regard to the unemployment rate, at least it has appeared to have stabilized. And I know much hinges on the global economy. There will certainly be some aftershocks for the next while, which is why I think after 2011, we'll have a better idea what things are doing. Oh, and durable goods orders have been up more than down this year.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot Last edited by Baraka_Guru; 12-23-2010 at 10:24 AM.. |

|

|

|

|

#7 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I know that there are a number of companies that laid off just before Christmas. I know that there are a few companies that are laying off after the New Year. The figures that I've seen are the soft figures the ones that are not reported to the government. So there's still lots of shenanigans going on.

There's still lots of people who 2 years ago got laid off and went back to school to retrain and retool. They took out student loans and federal aid, and aren't getting jobs. Their loans are now due. How will they pay them? Deferment? The CEO summit that Obama had recently: Quote:

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#8 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

Because they are trying to keep they books in a profit position for stockholder performance.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#9 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

The overall employment numbers shouldn't come as much of a surprise. When companies are uncertain about future growth, they tend to be conservative with their employee costs.

However, you might find that durable goods are up (and maybe even nondurable goods) because companies are spending money on increasing their efficiency through upgrading systems, etc., thereby being able to do more with less with regard to employees. This makes sense for them for two or three reasons: 1) fewer employees will save money, 2) interest rates are low (rock bottom even), and/or 3) certain aspects of the stimulus spending has encouraged such investment. So you get an environment that boosts the stock market and maintains a growth in industrial production despite weak jobs numbers and even a slippage in industrial capacity. As bad as it looks for jobs at the moment, the stage is set for an economic expansion. All that's left is for it to build more steam and for the general public to catch wind of it. And when they do (that is, when they realize there is money to be made), the jobs will follow. Of course, the way it looks, this will take some time to play out. Many people are still jittery. The more I think of it, the more I see 2011 as a turnaround year. The job numbers won't start looking up until after that time. It will probably start looking better during the presidential election, which will be interesting.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#10 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

That's pure speculation that they are upgrading and retooling. Are you basing that on any evidence such as stockholder reports?

Remember many companies in the US no longer manufacture on US soil so there is little to retool. If they are getting benefits for such streamlining, then reporting layoffs would not happen since they don't need to report laying off 100 Canadians or 100 Mexicans (I'm only using NAFTA for the moment, but that holds true for CAFTA and SE Asia manufacturing as well.)

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#11 (permalink) |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

When it's down no one thinks it will go up and when it's up people never think it will crash.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

#12 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

There are a lot of companies sitting on a lot of cash. What do you think they're going to spend their money on first? New employees? Or investments that will let them do more with less? Or do more faster and better? What do you think company A will think about company B's new initiatives when they are direct competitors? Durable goods purchases are up, including computers and communications and other electrical equipment. I'm not sure what the divide is like between consumer, industrial, and commercial uses, but it makes sense to assume that many of these purchases are to improve efficiency if not maintain it. I doubt this is all consumer spending. Businesses seek to remain competitive even in tough times. Investments like these happen all the time at this point in the business cycle when interest rates are low and people aren't ready to hire. Companies are always seeking ways to do business at a lower cost. They've been thinking this way for a while now. I think you mean "few," rather than "no one." I work with people who sell when people are buying like crazy and buy when people have liquidated their stocks. They know the market will plummet when it's up and they also know the markets always recover.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

|

#13 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I'm not pessimistic by any means. I just don't believe that these kinds of gains are reasonable in such a short period of time. Two years and we're up into double digits again? The smartest guys in the room have to have figured out another way of smoke and mirrors and passing the hot potato. Government regulation wasn't as heavy handed with the banks and financial institutions as it was with corporations after Enron, Tyco, MCI. They passed the Sarbanes-Oxley Act which severely hamstrings corporations with checks and balances so that the massive fraud won't happen again. I don't see the same type of corrections done by the Obama administration nor Congress.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#14 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Didn't you see the recovery after Black Monday of '87 or after the tech bubble? Sure these more recent drops have been much, much larger than in the past, but things are much different with all the technology and globalized economics these days. Capital flows are now much faster and in larger volumes. (Not to mention the plethora of different vehicles now available as well.)

And you have nations now turning to banking systems like Canada's to look for ways to make meaningful changes to prevent future disasters.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#15 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Durable goods orders can can be up many companies no longer purchase some if not many durable goods. Leasing is where it is at since there is no capital expense and no depreciation hits or complicated formulas to lock in for several years.

Many corporates no longer purchase computers, copiers and other imaging tools, and a host of other goods. Computers are on 3 year leases ensuring that A) it is not a capital expenditure, it is now an operational expense instead of a capital purchase B) since computer lifecycles are less than 3 years it makes retooling sense C) warranty repair on a 3 year old computer costs more for the company providing it than selling a new one. This applies to many of the durable goods you are citing. In effect, every 3 years our company replaces every single computer in our office. I've been at the company for 4 years now and have had 2 new computers, with no additional benefit since it was Windows XP before on the legacy machine. Windows XP on the first replacement and on the second replacement. Corporate is very leery of changing OS due to interoperability with legacy applications. My application will not work on IE8, and must run on IE6 or IE7. We're moving to Win7 in the next year or two but my app will have to be specially targeted because of that limitation.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#16 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

My overall point is that it is at this time in the business cycle when companies start spending money on things other than employees. Interest rates are low, so if they don't have the cash they can make the decision to take on upgrades before the upswing in the economy. It makes sense to do that now before interest rates go up again. And you can imagine the deals they could get with the economy the way it is as well. I imagine larger corporations or some of the experienced small business owners would be doing this having done it in the past. Why else would durable goods be up? I can't imagine it's all consumer spending. Not with employment levels where they are. EDIT: This is something else to note: Corporate mergers up, but effect acquisitions may have on job market is unclear Sure this will likely put downward pressure on employment, but it's telling of two things: 1) companies are willing to use their cash and take chances on mergers and acquisitions and 2) these things tend to happen with higher volume at the tops and bottoms of cycles. In other words, this is another indicator of prepping for economic expansion.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot Last edited by Baraka_Guru; 12-29-2010 at 11:22 AM.. |

|

|

|

|

|

#17 (permalink) |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

Yes, you are correct. I was just attempting to express that many folks I know seem to think it's an all or nothing system.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

#18 (permalink) |

|

Upright

Location: Alaska

|

Here we go again with the positivity rap. I am not against positive but I am against being bullshitted. We are on a Republican model of economic failure. Failure if you are the one being raped. Success if you are the rapist. Zero signs of the gangbang stopping anytime soon but hey the rapists are having a good time. And the ones who get on board with them they get a nice vicarious thrill.

It is not going to stop until there is direct intervention. Monopolisation, legalized tax fraud, free trade without levelling the playing field, subsidizing the people who are already raking it in, borrowing to pay for military expansion, out of control health care costs. There are more but these are the basics and they are the perfect storm for taking down a great country, our great country, doing it to itself because it does not have the guts, or the overpowering practical good sense, the moral good sense to stop it. |

|

|

|

|

#19 (permalink) |

|

Alien Anthropologist

Location: Between Boredom and Nirvana

|

Yes...In reality the Dow is up. Nice media bit for New Years. It ended on a plus note this year. My returns are creating funds that are barley keeping me & my husband out of the dog house though. Hard to live on a few thousand a month!

Hub lost his job last week & I've been unemployed for 9 months as some of you may remember.... If our investments weren't majorly based in the EU, China and the mid east...we'd be bankrupt. Hence. American companies still really suck and earn almost nothing/pennies. Just glad we have a good financial advisor. Still, Please Note: we aren't Republicans. Not counting on this slow small economic return to save us. We want work and realize that we're all being manipulated like cattle so the top 5% keep all their billions and party with the Chinese & Ragheads and watch us middle class die in poverty. So yeah, I'll go work at Dunkin' Donuts if I have to; to protect my savings & investments. To pay my bills and not use "credit" ever! As a realist am pretty flippin' sure there won't be Medicare or Social Security around when I need it. Sorry if I sound racial & mad. Maybe I am. I wasn't just a few years ago....but that's another post and another issue. I always try to speak the truth.

__________________

"I need compassion, understanding and chocolate." - NJB |

|

|

|

|

#20 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#23 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Here's an interesting forecast. I suppose now it's time to see if it pans out.

Quote:

It's becoming increasingly difficult to deny that the economy is gearing itself into a recovery, albeit a long, gradual one. Employment numbers will recover eventually if things stay on track with current numbers, it will just take a long time to return to previous levels. I think the biggest concerns at the moment are the state and federal budgetary problems and housing. The former? I'm not so sure what to think. I don't know much about what budgets cover on the state vs. federal level. I know that in the past, the Canadian federal and provincial governments came to certain agreements regarding the funding of certain programs. I'm not sure the same can be done in the U.S. I'm not sure whether it'll make sense. As for housing? This will likely be where the damage takes the longest to correct. I think the U.S. should adopt more of what we do here in Canada with regard to regulating the mortgage industry. The sub-prime crisis is an embarrassment that will take a long time to forget about. It should have never happened.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

|

#24 (permalink) | |

|

Invisible

Location: tentative, at best

|

Quote:

The long-term unemployed got no help from the tax bill. People out of work for 99 weeks are receiving no Unemployment Benefits; and never probably will again, with a Republican House. This will put further strain on States, and will result in further layoffs due to those Unemployment checks no longer being immediately put back into the economy. There are almost 2 million "99ers' right now, and our numbers are growing by a half-million each month. But you'd never know it from the way the media reports it. Oh - and BTW - it helps the official Unemployment figures, too. Since we're not collecting any longer, we're no longer counted as "unemployed." EDIT: ^^ That's why the Unemployment rate just "fell" from 9.4% to 9.0 %, even though less jobs were created last month than any month last year.

__________________

If you want to avoid 95% of internet spelling errors: "If your ridiculous pants are too loose, you're definitely going to lose them. Tell your two loser friends over there that they're going to lose theirs, too." It won't hurt your fashion sense, either. Last edited by yournamehere; 02-07-2011 at 12:40 PM.. |

|

|

|

| Tags |

| 37%, 46%, dow, sandp, years |

|

|