|

|

|

#1 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

AIG situation: What does it mean to you?

I've not posted much about AIG, mostly because it's happening so fast and I've been too busy that I keep missing a good starting point.

What does it mean to you? How do you feel about the bonus situation? What do you think should happen? I've been really upset about the AIG bailout from the beginning. As the companies that come out of this that show the monies that AIG paid out to German banks, Goldman Sacks, Merril Lynch, would have shown how the dominos would fall. I'm a believer that if you're taking risk, you should be taking that risk. When the bet is called and you lost. You lost plain and simple. Your company goes belly up. The bonuses, is just unconscionable. Congress fucked up and didn't due the due diligence. Congress should not abrogate the contracts and fishing a 90% tax is all just puffering and PR. Don't pin this on the Obama administration, he's got little to do with it because Congress voted for TARP. But stop feigning outrage... that's just stupid. You had your chance to vote when you were a senator and vocalize your concerns and opinions. And nothiong.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#2 (permalink) | |

|

I have eaten the slaw

|

Quote:

__________________

And you believe Bush and the liberals and divorced parents and gays and blacks and the Christian right and fossil fuels and Xbox are all to blame, meanwhile you yourselves create an ad where your kid hits you in the head with a baseball and you don't understand the message that the problem is you. |

|

|

|

|

|

#3 (permalink) |

|

has all her shots.

Location: Florida

|

Since when are bonuses to failing executives such a scandal? These guys are only expecting what has given before them.

Yet another perfect example of America giving a shit too little, too late. Only when it becomes a glaring offense to them personally does it become an issue. The more I learn about psychology, the more I realize that our advantages have kept us trapped inside the egocentric stage of development.

__________________

Most people go through life dreading they'll have a traumatic experience. Freaks were born with their trauma. They've already passed their test in life. They're aristocrats. - Diane Arbus PESSIMISM, n. A philosophy forced upon the convictions of the observer by the disheartening prevalence of the optimist with his scarecrow hope and his unsightly smile. - Ambrose Bierce |

|

|

|

|

#4 (permalink) | |||

|

Human

Administrator

Location: Chicago

|

Quote:

Eliot Spitzer actually wrote a good article on the AIG issue. He's clearly not a perfect man, but Wall Street was sure happy when he was ousted as governor. The Real AIG Scandal | The Big Money Quote:

__________________

Le temps détruit tout "Musicians are the carriers and communicators of spirit in the most immediate sense." - Kurt Elling |

|||

|

|

|

|

#5 (permalink) |

|

... a sort of licensed troubleshooter.

|

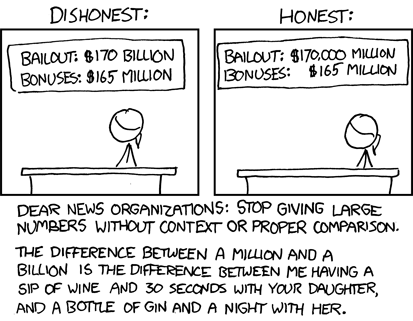

What does it mean to me? It's another MSM red herring. Of all the things that have happened around the economy and Wall Street, this is what people seem to agree is worth getting angry about? It's silly. Scratch that, it's stupid. Within the context of the spending recently, $165 million isn't even a pittance, a scintilla. It's nothing. Sure, one could argue it's symptomatic, but even as far as symptoms go, it's really tiny. Instead of concentrating on the huge problems that lead us to where we are now, instead of fixing the system which if left unfixed will lead to a true collapse of our economy, we're concentrating on $165 million in bonuses.

|

|

|

|

|

#6 (permalink) | |

|

Darth Papa

Location: Yonder

|

Quote:

|

|

|

|

|

|

#7 (permalink) |

|

Junkie

Location: Indiana

|

Man, I wish the media and the majority of Americans had a grasp on this issue like this board does. I'm amazed and apalled at the ability of the media and government to distract things that aren't that important in context.

__________________

It's time for the president to hand over his nobel peace prize. |

|

|

|

|

#8 (permalink) |

|

Kick Ass Kunoichi

Location: Oregon

|

I love xkcd.

It feels like a circus act. The media have been all over this story, pumping it up. Like will said, it's a red herring, a distraction. There's really not a whole lot going on here, but the media sure does a good job of making it seem like there is.

__________________

If I am not better, at least I am different. --Jean-Jacques Rousseau |

|

|

|

|

#9 (permalink) |

|

Junkie

Location: Detroit, MI

|

While compensating people with bailout money to the tune of 165 Million should be put into proper context, I don't think it unreasonable for people to still be pissed about it. Its just one more screwup in the whole sordid affair, taxpayer money still being thrown down the toilet. It's effed up that these people are getting compensated and its effed up that AIG is receiving billions of taxpayer dollars to keep it afloat. Ok we get it, one is petty larceny and the other is grand theft. What's the point in trying to downplay the compensation scenario anyway? What is it a distraction from?

|

|

|

|

|

#10 (permalink) |

|

Super Moderator

Location: essex ma

|

what it's a distraction from is easy: the brouhaha about the bonuses is a version of the "bad apples" theory.

aig is interesting in that it marked the point where even within the one-dimensional world of mass media coverage of capitalism, that shangri-la, that a frame problem surfaced--so wait, yer tellin me that a downturn in the amurican real estate market effects the transnational trafficking in "mortgage backed securities" (think of it as a traffic in holes, kinda in the way the beatles talked about with reference to albert hall in "a day in the life") effects global capital flows? so there is no "american economy" that's not intertwined with the global economy? this triggers other problems, really quite basic ones, which have to do with the extent to which people think in terms of objects and the extent to which televisual presentation of "reality" reinforces thinking in terms of objects...a corporation is a bounded entity, a thing: an economy is a bounded entity, a thing. a nation-state is a bounded entity, so a thing... but hey, why think about that when you can point to a group of mostly anonymous individuals (things) who cause the problems because of an inward defect ("greed") and who represent in that inward defect the kind of attribute that can be purged from the existing system and restore it to rationality, because we all know, following the "bad apple" theory, that the existing order is legitimate because it exists, no matter what it is, and that problems are caused by distortions introduced by Bad People--so there are not and cannot be system problems, basic problems... it'd be funny if the game that was being played did not have such high stakes.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#11 (permalink) |

|

Junkie

Location: Detroit, MI

|

It's like critiquing the reasons for a sinking ship, while you're busy invalidating the molecular properties of the water in the ocean. Well of course the ship isn't working properly, the damn water is all wrong. The whole argument is fundamentally flawed and will remain so until we refill the ocean with strawberry jello.

Last edited by powerclown; 03-20-2009 at 09:28 AM.. |

|

|

|

|

#12 (permalink) | ||

|

Junkie

Location: Ventura County

|

I think it illustrates how selective our government can be first when it comes to "bailouts" (many businesses/people fail and get no help from government, why AIG?) and second when it comes to tax policy (picking small groups of people for special taxation either higher rates or special deductions) - I think our government should treat all people the same.

Quote:

Quote:

I hope the Senate votes no on the tax billed passed in the House. If the bill is passed I hope it is challenged in court and over turned as unconstitutional.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||

|

|

|

|

#13 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

What does it mean to me? It's one of the major reasons I haven't been around much recently. It's revealed a lot of flaws in the insurance market. AIG is one of my major trading partners, and it's been a wild ride.

The bailout had to happen. If it hadn't, approximately 50% of the US airline fleet would have been grounded since the owners of the planes require the hull insurance to be rated "A" or better by AM Best (the standard insurance rating service). If AIG had declared bankruptcy, none of those planes could have flown since AIG writes roughly 50% of that business. That's not to count all the other corporate business that AIG writes that have similar covenants. The bonuses were stupid. AIG could have gotten out of them. Dodd's an idiot for allowing them to happen.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#14 (permalink) |

|

Psycho

Location: Anchorage, AK

|

The_Jazz: Good info, though I don't know why I haven't heard about the Tie with AIG and the air fleet.

I will have to research this some more. Back to OP: What does it mean to me? Well that we have to start questioning the people who pass these bills instead of AIG. How do I feel about the Bonus situation? Take it all back. I know if the government gave me money and I wasn't due this? They they WOULD take it back. What is so different here? Though we know this may not happen. So pissed I guess. What do I think should happen? Um.. well appoint Peter Schiff or someone of the likes who has a track record of knowing how we got here. I feel he could reverse it. Though no one really wants to hear his side, since it will take sacrifice on our part. Even when they ( The Gov.) put us here. |

|

|

|

|

#15 (permalink) | |

|

Human

Administrator

Location: Chicago

|

Quote:

__________________

Le temps détruit tout "Musicians are the carriers and communicators of spirit in the most immediate sense." - Kurt Elling Last edited by SecretMethod70; 03-21-2009 at 02:53 AM.. |

|

|

|

|

|

#16 (permalink) |

|

Nothing

|

I think we're all about to have a harsh lesson on the nature of the web of our social contracts. Mr Stewart was wrong. The entire economic edifice that has ever been and ever will, no matter the gains it has or will bring us, is at its root a game. There were a handful of people consciously playing the game at the highest levels, but a game they were playing. Money, even money backed by shiny metals, has no real, intrinsic value other than what we all somehow agree to place upon it. It's only a social contract, though mostly a hidden one. As we sit here the players, en mass and conscious as well as unconscious, have pushed the game into an irrecoverable position for certain social contracts in the world. Social contracts like the dollar and the pound will either not survive, or won't be recognisable as what they once were not too long from now. The total sums being magicked into existence to combat the current crisis in loans, bailouts, guarantees and insurance is roaring up towards 100% of US GDP over on your side of the pond, and way over 100%, more like 200% of GDP of the UK over on this side of the pond, mostly through black box entities and schemes that have very little details published, if any. There's no going back, and there's only a yawning abyss out in front of us - for the social contracts.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- Last edited by tisonlyi; 03-21-2009 at 02:16 AM.. |

|

|

|

|

#17 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

I've been thinking about this thread today, and I'm going to comment some more. This is something that I've been talking about at least once a day every working day since I was in San Diego in mid-September.

The vast majority of AIG was run very well and very profitably. When this first started last year, AIG was, without a doubt, the best run insurance company out there with the best talent in the industry (on the carrier side, at least). Unfortunately, a lot of very smart people have been tarred with the same brush used on the Financial Services guys. If you think that the Financial Services guys are scum of the earth, think again. Basically, the guys at Goldman Sachs et al came up with the credit default concept. They convinced the Financial Services guys, who were a very small unit, to write the coverage for the swaps. The same folks had also convinced Congress that the concept was legal AND a good idea. The head of AIG at the time, Hank Greenberg (IMO one of the great insurance minds in history) personally signed off on each and every deal they wrote until he was basically pushed out in the Spitzer investigations about 5 years ago (something completely unrelated to this). His successor, Michael Sullivan, signed off on the rest of the swaps. It turns out that the checks that they all thought were in place actually weren't. In reality, a bunch of very smart people were swindled in one of history's greatest cons. Even better, the Goldman guys were so brazen that they started buying the swaps at the end, only on the side that bet that the mortgages that this whole mess drew from were actually worthless. They made money on the front end AND the back end, and they had the foresight to make sure Congress made that completely legal. As I posted in the other thread, AIG declaring bankruptcy would have been horrific. First, the rating agencies would have been forced to downgrade AIG. In my world, if you go below "A-", you might as well be dead. At the time, they were "A". A bankruptcy, in the best of circumstances, would have seen them go to "B++" (more likely "B"). A lot of commercial loans require insurance by an "A" or better carrier. In Florida alone, AIG writes about 20% of the commercial Property market. Think about the turmoil of all of those loans having to be either rewritten or the insurance replaced. But that's just inconvenient. The real problem is that the 50% of the commercial air passenger planes are covered by AIG (they also own a bunch of them). The same rules apply (because as the owner, AIG insisted on it). That would have grounded about half of the commercial airplanes in this country. Think about that. It goes on, too. Ships. The cargo on them. Trains in some countries. Big construction projects that have to stop. It would have been a nightmare. I have more, but it's time to take the boys to the playground. I may revisit this, though.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#18 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Thanks Jazz that's some good insight to why it is important that they didn't fail as an insurance company. I think that some media should have explained why in the exact same manner.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#19 (permalink) |

|

Nothing

|

there are no facts there, just narratives.

JP Morgan basically invented CDS's, they were taken up with gusto at AIGFP. If you really believe the PoorAIG! stuff, then please explain their exposure to naked CDS's. Did someone at GS and countless other institutions convince AIG to take money on what they considered to be long odds bets on a game neither AIG or the other gambling addicts had any skin in? AIGFP were horrifically greedy, and insanely stupid if that's the narrative of least resistance you want to go through... there are basically no other narratives that even begin to hold water unless you want to get into deep conspiracy territory on whichever side. Though i agree there is a decent division of AIG in traditional sorts of insurance which should be spun out pdq.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#21 (permalink) | |

|

Easy Rider

Location: Moscow on the Ohio

|

Quote:

Surely they knew these were a recipe for disaster. I would surmise that this was a very stupid thing to do but it seems like many of those involved personally made lots of money and probably do not need to work anymore so perhaps for them the risk of destroying their company was worth it. Unfortunately they took the rest of us down as well. |

|

|

|

|

|

#22 (permalink) |

|

Nothing

|

There are two options most likely, imho:

1) Their ridiculous abstractions and fairy story devices, or 'financial modelling tools' were engineered to prevent the idea that reality may ever intervene in the housing and other markets. In fact, I hear that the prediction software frequently deployed by one or to two institutions forbade the entry of negative house price increases... 2) They knew what they were doing. They were being paid per transaction, hence they didn't care about the outcomes... they were earning more than enough 'fuck you' money to see out the rest of their lives in ease. The only question was how much luxury would the rest of their lives contain? Currently, The US govt is rating that at about 12 trillion dollars or 'all in'.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#23 (permalink) |

|

Asshole

Administrator

Location: Chicago

|

First and foremost, AIGFP was a tiny division of one of a huge multinational company, both in terms of number of people and in revenue. It's not like this was National Union or American Home (two of the big insurance divisions).

I don't think that there are many people, with the benefit of hindsight, that would call the swaps anything but a bad idea. However, at the time, that wasn't quite so obvious. You need to realize that the AIG mindset played a big role here. Think of the nastiest, dirtiest thing to insure that you can, and AIG probably writes it. Gun manufacturers. Hotels on the beach in Key West. California condominium builders. They have written new coverage for buildings that are actually on fire at the time knowing that they will have to pay a loss. Basically, they'll do anything for a price. AIGFP had most of their employees in London for a reason. London insurance, while not really unregulated, operates as the ultimate insurance market, where anything can be bought, which is why you see people insure their legs or hair or whatever there. In London, it is not unknown (though it is a little unusual) for someone to bet against something. If you think that the AIGFP folks were gambling addicts, I think that you need to examine the very nature of the business. The entire thing is a gigantic gamble, especially when you're dealing with something that doesn't have a proven track record. If you want to examine mistakes that were solely AIG's (i.e. no one conned them), then basically it was that they moved away from their core business model on these deals and didn't do the underwriting necessary to understand exactly what was going on with the mortgages. That said, there hadn't been a negative housing market since the 1930's, and there was no reason to think that one was even possible until mid-2007.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

#24 (permalink) |

|

Easy Rider

Location: Moscow on the Ohio

|

It seemed obvious to me (from a layman's point of view) that houses were way over priced as early as 2003 when we sold our house in Seattle. The local paper even ran an article about how 50 to 70% of the people in our area would not qualify to buy their own house at the current prices.

Isn't it obvious that most people cannot afford much more than 3 times their annual earnings without a crazy adjustable rate (time bomb) mortgage. Surely the professionals that dabble in these things knew prices had to come down. Just because someone making $75,000 a year can get a mortgage for $400,000 does not mean they can afford it. Especially if they are denied refinancing before the monthly payment resets and goes up. |

|

|

|

|

#25 (permalink) | ||

|

Nothing

|

AIGFP were totally, utterly out of control.

If the Rolling Stone article is a tad too low brow or lengthy to cast your eye over, then maybe this one is ok, or at least the part in bold: The Rise And Fall Of AIG's Financial Products Unit Quote:

Characterise that as small if you like, but even if they only have to stump up 10% collateral on that $2.7tn, you're getting on for doubling the sums that have already been vaporised by the AIGFP Death Star. The difference between AIG and AIGFP is like night and day, to try and characterise them as somehow equivalent is... well... inaccurate. AIG the traditional insurer uses actuarial methods, tried and true underwriting, etc etc to provide well capitalized, well regulated, well understood insurance to real people and companies for real disasters through systems that have been around in one form or another since a couple of Scottish Enlightenment clergy types - who liked a wee dram or two - decided to set up a life insurance scheme for the widows of clergy around 200 years ago (it still exists as part of LloydsTSB-HBOS, but not for much longer most likely). AIGFP is/soon-to-be-was totally unregulated and totally uncapitalised, went balls out to make sure it stayed that way, used financial products that i'm pretty certain none of the execs or traders had ever looked through, much less understood (anyone who has seen the incredibly large and densely mathematical pile of papers that makes up a real CDS will get the gist of that), the lack of collateral that their old AAA rating used to bring to rack up mountainous, ruinous piles of unbacked, unregulated and untested 'insurance' that was really nothing but a bet taken at something like 1:100 or 1:1000, based on insane statistical modelling that takes things which demonstrably occur every decade, generation or century or so and represent them as billions-to-1 likelihoods. (Markets, like most social phenomena, are not Gaussian) These things are not similar in any way. Comparing them is like comparing an Acupuncturist to an MD. They both use needles, both in the area of healthcare, but one is ever so slightly more credible, tested and reliable in the curing business than the other. As for this only getting worse, prepare to see a lot more of this sort of thing. (80% drop in the price of a house) Quote:

Oooooohhh.... ve ver ohnalee obeeeyink ohrders.... Godwin! It's there! -- As a complete aside... you've got to love this shot of the current AIGFP head, the one who came in after the govt takeover:

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- Last edited by tisonlyi; 03-22-2009 at 01:26 PM.. |

||

|

|

|

|

#27 (permalink) |

|

Super Moderator

Location: essex ma

|

thanks jazz--very interesting stuff.

the traffic in holes (debt bundling) required a wholesale separation between the fees that could be made through the circulation of the devices and what the devices actually represented. it seems to me like the entire way of trading was not that different from juggling--so long as the elements within the system kept moving and folk were only thinking about quarterly returns, shareholder profits and commissions/bonuses things were *kinda* functional--but once the machinery started to come undone, suddenly there were enormous bags and firms left holding them and epic levels of debt, backed to the hilt by outfits like aig....it's lunacy if you look at it, but i don't think anyone was looking at it so long as the wheels inside the wheels kept moving---cowboy capitalism is not about rational planning or action if rational requires thinking in durations longer than a quarter. traders make heaps of cash, p&l looks good, everyone's fat and happy--that's as far as thinking went, as far as it had to go. add to that the fact that there was and still is no clearinghouse through which the traffick in these devices had to pass, so no transparency as to valuation and so no transparency as to meaning----this is an automated world of numbers, so abstractions. it really was and is lunacy.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#28 (permalink) | |

|

Junkie

Location: Indiana

|

Quote:

__________________

It's time for the president to hand over his nobel peace prize. |

|

|

|

|

|

#29 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

From what I understand there is a risk that a percentage of claims will be made and that never or rarely will the risk equal the entire holdings of the company. Is that a correct assesment?

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#30 (permalink) |

|

Super Moderator

Location: essex ma

|

in "looting"--i made a thread about it a little while ago--the argument is that deposit insurance eliminated "moral hazard" at the level of banks which involved themselves in this lunatic trade in debt securities---but i think compartmentalization at the level of organizational culture was more important. that and the assumption that these devices would stay in motion.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#31 (permalink) | |

|

Junkie

Location: Indiana

|

Quote:

__________________

It's time for the president to hand over his nobel peace prize. |

|

|

|

|

|

#32 (permalink) |

|

Easy Rider

Location: Moscow on the Ohio

|

You know, the more I think about it, maybe it is not so risky when there is someone waiting in the wings to replenish all the money you gambled away. Perhaps these guys are very smart and worth additional bonuses for the win/win situation they created for themselves and their companies.

|

|

|

|

|

#33 (permalink) | |

|

Asshole

Administrator

Location: Chicago

|

Quote:

Yes, AIG has written coverage for buildings that are on fire at the time. They did it for a friend of mine, and it wasn't the first time. It was very expensive, it was very specific and they ended up making money on the deal. Another case in point - years ago, they wrote an excess liability policy for me over one specific claim that had already occurred. My insured owned a truck that had hit a worker in a construction zone. She was in a vegatative state and would need care for the rest of her life, between 10 and 30 years. There was a suit in court by her family, and my insured was in the process of selling their company to someone. The new owners were concerned about successor liability and wanted to see if they could cap the claim. AIG wrote $5M excess of the $5M that the insured had in place at the time of the claim after reviewing the facts and discussing it with their accuaries. That's fucking ballsy in my book. Here's the thing about insurance, regardless of whether or not it's liability, property, auto or whatever. If all your policyholders have an insurable limits loss (the maximum payout of the policy) at the same time, the insurance company is going out of business. No exceptions. The AIGFP folks thought that there was no way that it could happen to them. Clearly they were wrong. Really what they were doing wasn't insurance at all, though. It was an altogether different type of risk transfer on something that really should have been a business risk. Cyn, you're right about how insurance is supposed to work. It should be almost impossible for the gears to sieze like it did with AIGFP. In most insurance (maybe not so much with what I do), it is actually pretty much impossible on this scale. Even if Fargo, ND burns to the ground (for instance), there should be enough spread of risk that no one carrier takes it on the chin so badly. Even Katrina, the biggest property loss that's ever happened in the US, didn't put anyone out of business. Then again, Reliance Insurance, who had been in business since the 1860's, went down because of a reinsurance spiral on Workers Compensation back in the 90's (they bought insurance on books of business from themselves - just stupid really), so companies do dumb things all the time.

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

|

#34 (permalink) | |

|

Nothing

|

Bernanke Bombshell: AIG Insurer Exposed to FP | The Big Picture

Quote:

The mess just seems to keep getting messier.

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

|

#35 (permalink) | |

|

Asshole

Administrator

Location: Chicago

|

http://www.nytimes.com/2009/03/25/op...=2&ref=opinion

Quote:

__________________

"They that can give up essential liberty to obtain a little temporary safety deserve neither liberty nor safety." - B. Franklin "There ought to be limits to freedom." - George W. Bush "We have met the enemy and he is us." - Pogo |

|

|

|

|

|

#36 (permalink) |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I read this earlier and I'm confused as to how their bonuses are derived. It could be because I've not achieved that level of employment.

But my bonus eligible positions at 10% or 15% of my annual salary was stated as simply that. Accountants muckied with that and eventually it was a percentage of the target of the pool or something stupid like that. Ultimately I never got the full 15% ever. Eventually, as the economics changed in 9/11 they just said, no bonuses. Yet I had a piece of paper that said, I was to get a 15% bonus. I definitely didn't want the government to abbrogate the contracts, but the company could have done something I'm sure of it.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

#37 (permalink) |

|

Nothing

|

Of course, he knew nothing about it. He was in the other room while they were gassing the prisoners.

Godwin II

__________________

"I do not agree that the dog in a manger has the final right to the manger even though he may have lain there for a very long time. I do not admit that right. I do not admit for instance, that a great wrong has been done to the Red Indians of America or the black people of Australia. I do not admit that a wrong has been done to these people by the fact that a stronger race, a higher-grade race, a more worldly wise race to put it that way, has come in and taken their place." - Winston Churchill, 1937 --{ORLY?}-- |

|

|

|

|

#38 (permalink) | |

|

Easy Rider

Location: Moscow on the Ohio

|

Quote:

That being said I don't agree with the rushed through 90% tax either. The government should have made withdrawing the bonuses a condition for getting the bail out in the first place. I think AIG should not pay any bonuses while being kept alive by the taxpayers and instead let those who think they are owed bonuses fight it out in court for the next 5 years. AIG might still be around in some fashion and if not they can get in line with everyone else owed money including the American people. |

|

|

|

| Tags |

| aig, situation |

|

|