|

|

|

#1 (permalink) |

|

Addict

Location: The next town over

|

Gas Prices...

I just started watching an older movie, The Survivors (1983) starring Walter Matthau and Robin Williams. In an opening scene, Robin Williams pumps gas at a station owned by Walther Matthau's character. I found it interesting that gas prices at the time the movie was shot were $1.41/gal for unleaded. That is roughly comparable to today's prices, 26 years later with no adjustment for inflation. I find it incredible that we have subsidized gasoline to the point that prices have not changed in 26 years. Can anyonce think of exmaples of other commodities that have similar price histories?

__________________

"All it takes to make a difference is the courage to stop proving 'I was right' in being unable to make a difference, to stop assigning cause for my inability to the circumstances outside myself, to be willing to have been that way, and to see that the fear of being a failure is a lot less important that the unique opportunity I have to make a difference." -Werner Erhard |

|

|

|

|

#2 (permalink) | ||

|

Junkie

Location: Ventura County

|

Quote:

In 1982 based on my memory and WikiAnswers Coke was about $1 for a liter. You could get a 2 liter bottle for a bit more or less if you got it on sale. Quote:

Today, I can get a two liter bottle for about the same price. I think the price of gas has more to do with the abundant supply of oil on this planet. Price spikes are often due to factors outside of the amount of oil in the ground.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||

|

|

|

|

#3 (permalink) |

|

Riding the Ocean Spray

Location: S.E. PA in U Sofa

|

ahh, the good old days

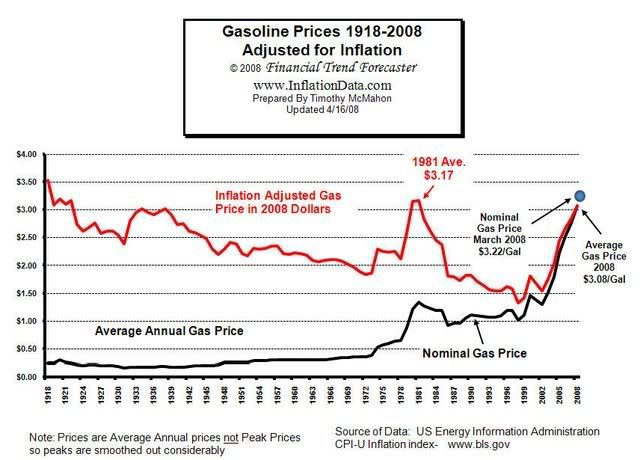

...I recall buying gasoline when it was under $0.30/gal (U.S.). Back then cigarettes cost ~ $0.22 a pack. ...I recall buying gasoline when it was under $0.30/gal (U.S.). Back then cigarettes cost ~ $0.22 a pack. I bet other commodities with pricing manipulated by our government or other cartels also show "deviant" behavior...I don't have data but I'd expect to see that for corn, milk, gold. I recently came across this graph that shows "inflation adjusted" price of gasoline and it does not even include the most recent drop back to "normal" ~$2 +/- levels that are currently in effect.  |

|

|

|

|

#4 (permalink) |

|

Junkie

Location: San Francisco

|

I don't understand the point of this thread at all. Most commodity prices follow inflation with exceptions if the cost of production or demand changes suddenly. That is pretty much what the graph shows for oil. Demand is inelastic but the cost of production gradually decreases over time. The two spikes have obvious causes, the 79 oil crisis and the 08 financial bubble. You'll note that movie was produced shortly after the former. Now, as the graph needs to be updated to reflect, prices are almost back to where they were. One could expect the cost of production to INCREASE gradually in the future, but despite the protests of the peak oil crowd that still has yet to happen.

__________________

"Prohibition will work great injury to the cause of temperance. It is a species of intemperance within itself, for it goes beyond the bounds of reason in that it attempts to control a man's appetite by legislation, and makes a crime out of things that are not crimes. A Prohibition law strikes a blow at the very principles upon which our government was founded." --Abraham Lincoln |

|

|

|

|

#5 (permalink) | |

|

Addict

Location: The next town over

|

Quote:

__________________

"All it takes to make a difference is the courage to stop proving 'I was right' in being unable to make a difference, to stop assigning cause for my inability to the circumstances outside myself, to be willing to have been that way, and to see that the fear of being a failure is a lot less important that the unique opportunity I have to make a difference." -Werner Erhard |

|

|

|

|

|

#6 (permalink) |

|

immoral minority

Location: Back in Ohio

|

I'm starting to think that gas prices going up last spring was what popped the housing bubble.

If I had to guess, knowledgble investors had to get out of the housing game, so they bought commodities like oil. People drove just as much, but switched what they were spending money on. More money was leaving the country. Companies that could raise prices or charge a surcharge did (and some haven't removed them yet). Companies weren't making as much money, and didn't hire or laid-off staff, which increased foreclosures and lowers home demand and prices. |

|

|

| Tags |

| gas, prices |

|

|