Fiscal conservatism is self-contradictory in the context of today's economic environment. It wants to reduce spending, which is fine if spending isn't getting the return it should. And I understand that with the reduction of spending, you will have an easier time balancing the budget, which is great. However, lowering taxes at the same time is counterproductive, especially when you think about actually paying off the public debt, and especially when taxes are relatively low to begin with.

Why reduce spending only to reduce income and

still hope to balance a budget

and pay down debt?

If you run up a debt to a level that you'd consider too high, it helps to both reduce spending

and increase income.

I call that "fiscal rationalism."

Compare and contrast the difference between the value of tax collections to pay off debt vs. interest cost.

Maybe it's just because I live in "Soviet Canuckistan," but the tax issue in the U.S. just boggles my mind. The cry to reduce taxes, extend the Bush cuts, etc., is ridiculous considering the sore fiscal shape the U.S. is in. Spending in itself isn't the problem. It's how the money is being spent (and I'm not just talking about the stimulus here; I'm talking historically). It's the low tax rate and the high public debt.

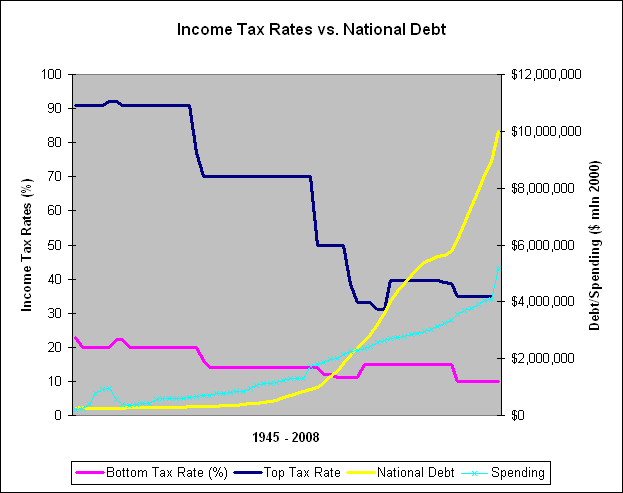

Now it's time for some pretty pictures:

In a nutshell: thanks probably in large part to Reganomics, the top earners in the U.S. are paying far less in tax than they have historically. Moreover, the increases in national debt has outstripped the increases in spending. Why? Well, it's simple: fewer tax collections to pay for that spending (i.e. it's not just the interest).

The average tax burden is at a 40-year low. What an odd time to be paying less in taxes. What at odd time to demand paying less.