Quote:

Originally Posted by Baraka_Guru

Of course there are political obstacles. But in the Oil Sands, the biggest challenge is the cost of extraction/production due to the nature of the oil in the sands vs. a well. Only fairly recently has technological developments made it such an attractive place to invest. Even still, it's only when oil prices are above a certain point will it remain so. The margins on oil extraction from "traditional" rigs are much higher than the extraction process from the sands.

|

When we detail the cost structure we find that there is the costs associated with on-going production and then there are costs associated with initiating production. Here is a source illustrating some of the costs

Quote:

Per-Barrel Operating Costs Down to $33

Already there are signs that costs are coming down. Suncor's per-barrel operating cost declined to just over $33 per barrel during the first quarter of 2009, down considerably from the $41 per barrel cost reported during the last quarter of 2008. Other major oil sands producer Syncrude, a consortium operation which includes ConocoPhillips (NYSE:COP) among its owners, is also targeting a reduction in per-barrel operating costs to $33 this year. With these lower operating costs, Suncor estimates that it will still generate a double-digit return from its existing operations, even at crude prices in the high $40 to low $50 per barrel range.

Petro-Canada recently re-estimated the capital cost of its Fort Hills oil sands project and saw that number fall from C$14 billion to C$10 billion, a drop of about 30%. Husky Energy (OTC:HUSKF, TSX:HSE) also re-crunched the cost of its "sunrise" project and saw that estimate fall by nearly 50%, from $4.5 billion to $2.5 billion.

Incidentally, Suncor and Petro-Canada recently agreed to merge, in part to realize about $1.3 billion in savings from operating synergies. (Learn how to invest in companies before, during and after they join together in The Merger - What To Do When Companies Converge.)

New Project Breakeven Cost Now Estimated at Just $60 Per Barrel

As a result of these cost reductions, analysts have now revised their breakeven cost for new oil sands projects from $80 to $100 per barrel to something closer to $60 a barrel – just a hair shy of the current price.

Small wonder then that investment dealer Goldman Sachs recently did a major about-face on the oil sands producers, upgrading the shares of Suncor and Petro-Canada from "sell" to "buy" and raising its price targets on Nexen (NYSE:NXY) and Canadian Natural Resources (NYSE:CNQ), despite retaining a "neutral" opinion on the latter two companies.

The Bottom Line

Both Suncor and Petro-Canada have realized huge gains in the last three months, gaining 58% and 70% respectively. With oil still shy of the $60 a barrel price, what now looks like the trigger-point to revive of many of the stalled oil sands projects, share prices could be somewhat ahead of the fundamentals at this point. But if any pullback in the shares takes place, a second buying opportunity could present itself for an industry many had just recently written off as economically unviable. (Before jumping into this hot sector, learn how these companies make their money. See Oil And Gas Industry Primer.)

|

Cost Cuts Restore Oil Sands Viability

Also if we look at the typical trending of operations cost, as illustrated above, with new technology and new processes, cost will trend down until they "mature" or level out. I doubt we have seen that "maturity" with oil sands. Producers of commodities understand the nature of these costs as it applies to the things they control. What they do not control are the "politics", the "politics" are an uncertainty. A relatively small "political" cost per barrel can materially alter the profitability of a project. It may alter it enough to cause a company to "green-light" a project or to stop a project. If politicians give clear signals of what they will do "politically", companies will make better long-term decisions. Understanding that "operating costs" will trend down, the short-term cost of oil will have minimal impact on these large projects, but the "political" costs, given uncertainty, can have a much bigger impact.

---------- Post added at 09:50 PM ---------- Previous post was at 09:41 PM ----------

Quote:

Originally Posted by Baraka_Guru

China might seem behind to you, but methinks they're catching up.

|

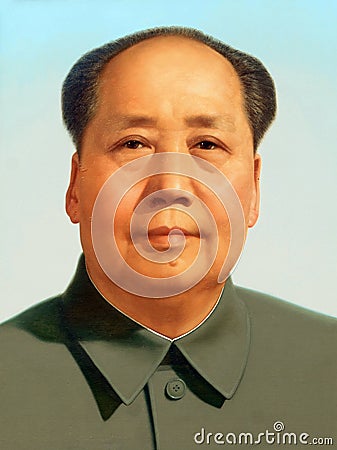

I do not underestimate China, to the contrary I think we need to understand that China is a force not to be taken lightly. I don't take our life-style and living standards for granted. I want to be free to choose my own wall art, I don't want to wake up to this every morning: