Quote:

Originally Posted by flstf

- His tax cuts do not go far enough to help the poor and middle class who pay a higher percentage of their income than the wealthy to support our government.

- Gun control.

- School vouchers.

|

I disagree with what Obama is proposing on taxes for two reasons. One is outlined in the Op Ed piece in the Wall St. Journal on July 21, 2008 that I've quoted below. The top 1% of earners (those making in excess of $388,000 / year) paid 40% of the US Tax burden in 2006. 1% of the population pays 40% of the bill. The top 50% of earners pay 97% of the tax burden. How much more can the top half pay to support the bottom half so that you will call it fair?

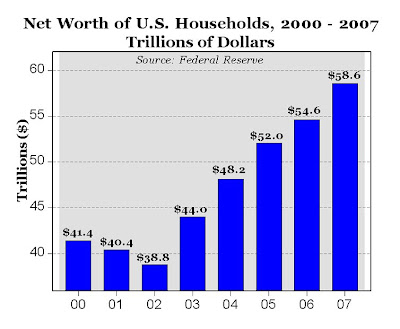

The second reason is that during the correlating period of time with the 2003 tax policy the real net worth of

ALL American households (the sum total of all assets minus liabilities) exploded by 43% to a record $58 Trillion. Yes that's Trillion with a T. The tax policy passed in 2003 worked as predicted just as tax rate reductions have time and time again throughout history. And yes...it worked for all Americans.

Check this out...

The really amazing line item burried in that data and what should be part of the story this election season is that over that three year period the number of US households with adjusted gross incomes of over $1,000,000 nearly DOUBLED at a rate far faster than at any time in US history. Lower taxes mean opportunity...

Before you start to think I am a shill for the Bush Administration let's talk about the real failure which is again not taxes. The failure of the Bush Administration, AND both Republicrats and Democans in congress is not the tax policy of 2003. The real failure is that they just can't help themselves. They spend money like drunken sailors on a weekend bender in Bangkok and then at election time they engage is this piss poor idealogical food fight over who fucked up the budget and by how much.

Higher taxes = slower growth, the wealthy will pay less, and there will be less opportunity because the investment capital that would otherwise be out there to create jobs disappears into the portolet on the Potomac. Conversely lower taxes leads to just the opposite but at the same time you cannot spend more than you make. Period. Or...as many people are willing to do just --->

Send more money to Washington because it's the patriotic thing to do and watch party imbicile after party imbicile insult your intelligence by telling you that the rich just aren't doing their part. The fact that there are as many Americans willing to believe this pile of horse feathers that seemingly do is astounding.

------------------------------------------------------

Wall St. Journal - Op Ed, July 21, 2008

------------------------------------------------------

Quote:

Washington is teeing up "the rich" for a big tax hike next year, as a way to make them "pay their fair share." Well, the latest IRS data have arrived on who paid what share of income taxes in 2006, and it's going to be hard for the rich to pay any more than they already do. The data show that the 2003 Bush tax cuts caused what may be the biggest increase in tax payments by the rich in American history.

The nearby chart shows that the top 1% of taxpayers, those who earn above $388,806, paid 40% of all income taxes in 2006, the highest share in at least 40 years. The top 10% in income, those earning more than $108,904, paid 71%. Barack Obama says he's going to cut taxes for those at the bottom, but that's also going to be a challenge because Americans with an income below the median paid a record low 2.9% of all income taxes, while the top 50% paid 97.1%. Perhaps he thinks half the country should pay all the taxes to support the other half.

Aha, we are told: The rich paid more taxes because they made a greater share of the money. That is true. The top 1% earned 22% of all reported income. But they also paid a share of taxes not far from double their share of income. In other words, the tax code is already steeply progressive.

We also know from income mobility data that a very large percentage in the top 1% are "new rich," not inheritors of fortunes. There is rapid turnover in the ranks of the highest income earners, so much so that people who started in the top 1% of income in the 1980s and 1990s suffered the largest declines in earnings of any income group over the subsequent decade, according to Treasury Department studies of actual tax returns. It's hard to stay king of the hill in America for long.

The most amazing part of this story is the leap in the number of Americans who declared adjusted gross income of more than $1 million from 2003 to 2006. The ranks of U.S. millionaires nearly doubled to 354,000 from 181,000 in a mere three years after the tax cuts.

This is precisely what supply-siders predicted would happen with lower tax rates on capital gains, dividends and income. The economy and earnings would grow faster, which they did; investors would declare more capital gains and companies would pay out more dividends, which they did; the rich would invest less in tax shelters at lower tax rates, so their tax payments would rise, which did happen.

The idea that this has been a giveaway to the rich is a figment of the left's imagination. Taxes paid by millionaire households more than doubled to $274 billion in 2006 from $136 billion in 2003. No President has ever plied more money from the rich than George W. Bush did with his 2003 tax cuts. These tax payments from the rich explain the very rapid reduction in the budget deficit to 1.9% of GDP in 2006 from 3.5% in 2003.

This year, thanks to the credit mess and slower growth, taxes paid by the rich may fall and the deficit will rise. (The nonstimulating tax rebates will also hurt the deficit.) Mr. Obama proposes to close this deficit by raising tax rates on the rich to their highest levels since the late 1970s. The very groups like the Congressional Budget Office and Tax Policy Center that wrongly predicted that the 2003 investment tax cuts would cost about $1 trillion in lost revenue are now saying that repealing those tax cuts would gain similar amounts. We'll wager it'd gain a lot less.

If Mr. Obama does succeed in raising tax rates on the rich, we'd also wager that the rich share of tax payments would fall. The last time tax rates were as high as the Senator wants them -- the Carter years -- the rich paid only 19% of all income taxes, half of the 40% share they pay today. Why? Because they either worked less, earned less, or they found ways to shelter income from taxes so it was never reported to the IRS as income.

The way to soak the rich is with low tax rates, and last week's IRS data provide more powerful validation of that proposition.

|