|

|

|

#681 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

---------- Post added at 11:04 AM ---------- Previous post was at 11:02 AM ---------- Well it is also a mighty leap of logic to assume that I think you believe everything Obama says, just because you voted for him. However, I stand by my contention that you, Derwood, believe that only the federal government can fix the banking industry, the auto industry, and the healthcare industry.

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#682 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Just as a refresher, M1 data, from the past few few months, in billions of dollars: 2008 10 1474.7 2008 11 1523.2 2008 12 1595.3 2009 01 1576·3 2009 02 1559·6 2009 03 1563·3 2009 04 1593.3 2009 05 1597.0 2009 06 1650·0 2009 07 1654.7 2009 08 1649·9 So slightly less than 200 billion dollars were added to the economy. Of course, m1 as indicative of anything has long been out of style, but since you still cling to good old Friedman, at least you should get the data right. |

|

|

|

|

|

#683 (permalink) |

|

Super Moderator

Location: essex ma

|

ok so i was off doing real-life stuff and so wasn't around to monitor the playpen. but how about it folks? enough with the name-calling and enough of the walking up to the line between that and something else so you can piss across it. thanks.

__________________

a gramophone its corrugated trumpet silver handle spinning dog. such faithfulness it hear it make you sick. -kamau brathwaite |

|

|

|

|

#684 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#685 (permalink) | |

|

Who You Crappin?

Location: Everywhere and Nowhere

|

Quote:

I hope you're comfortable with this contention, as it's false. You and Ace look like you have something in common |

|

|

|

|

|

#686 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

---------- Post added at 11:44 AM ---------- Previous post was at 11:43 AM ---------- So the people can fix those things? Great, looking forward to your opposition of the bailouts and the healthcare bill and cap and trade, etc. Come on man, at least admit it.

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#689 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

And I don't know how you think the world works, but this whole "They haven't had their currency revalued in ages because they are still considered a third world nation" is nonsense. There are no distinctions between "third world nations" and "first world nations," and the central bank of each nation basically determines their exchange regime and a sustainable exchange rate. Some will let it float, some will peg it, but it is still determined in the open market, with none or some central bank intervention. And the UN has absolutely nothing to do with exchange rates, so that is more uninformed foolishness. Finally, I would love to know why you value all these distinctions between m1, m2 and so on and if its anything other than just throwing nonsense out there to see what sticks. In any case, another swing and a miss. M2 has increased by about 120 billion under Obama, so the "trillions" thing is still false. Last edited by dippin; 10-16-2009 at 12:39 PM.. |

|

|

|

|

|

#690 (permalink) | ||

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

---------- Post added at 07:31 PM ---------- Previous post was at 07:21 PM ---------- Quote:

As for "Under Obama..", I am not talking about Obama and never have. I am talking about the federal government. As for the rise in currency, I am talking about since 2001. I will apologize for not qualifying my statements with a date range. I know you guys all get caught up in an Obama vs. Bush thing. I don't differentiate as I find both of their governments overstepped their bounds tremendously.

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

||

|

|

|

|

#691 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

Wow. Just wow. There is no "World Monetary Fund." There is the International Monetary Fund. And while the International Monetary Fund does provide funds to nations in distress to stabilize the economy and the exchange rate (often with disastrous effects), the last time the IMF lent to China it was a standby loan and the deal ended in 1987. And the only way the IMF would be able to force any sort of change in exchange rates would be by enforcing the conditionality of the agreements IF it had lent China anything. In fact, China has been increasing it's purchase of IMF Bonds, and increasing its quota, which means that it has been giving the IMF money, not the other way around. And no, the World Bank does not determine exchange rates one way or another. And you've yet to explain how M2, added over a decade, will lead to hyperinflation. And why m2, not m1 or m3. It is amazing to me how you so stringently defend opinions when it is clear that you have no idea what you are talking about. |

|

|

|

|

|

#692 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

The crux of your argument, however is correct and I concede it. I did as much reading as I could on the subject and while various reports state an underevaluation between 9.5% and 54%, those calculations vary based on the bias of the researcher and are virtually impossible to calculate accurately. In fact, some believe the renminbi is even overvalued because clearly with an approximate 40% savings rate among Chinese citizens, they can easily afford everything they need with less money than they are paid. The US dollar's current value in comparison to the renminbi is a favorable position for the U.S. Primarily, it allows us to purchase Chinese goods more cheaply as China pays their workers poorly(depending on which research you read) and with "cheap" money. This arrangement allows our lower class to continue to purchase more affordable goods from China. Since most U.S. goods which go to China do not compete directly with Chinese goods, we run little risk of having an unfavorable position if their people choosing the cheaper Chinese product over the more expensive U.S. product. However, your original statement in this thread of thought was that the U.S. dollar is overvalued. I don't understand that assertion. According to what standard? And as an American, why is this a bad thing? Why would you want your money which you get paid to be worth less? I'm not picking a fight, I just don't understand the statement. As for the whole M1,M2,etc - I'll just have to read some more and get back to you. In short, the debt will eventually have to be monetized and the inflation is inevitable. I'll read some more though. (We'll talk about it more later. Perhaps another thread in Economics)

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." Last edited by Cimarron29414; 10-23-2009 at 08:06 AM.. |

|

|

|

|

|

#693 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

As far as the dollar being overvalued, I say that basically because the US has accumulated trade account deficits for a very long time. I.e., for the deficits to disappear the dollar would have to be worth much less. And a currency being overvalued is not good. The idea that the dollar being worth more=good is false. It means that while a dollar buys more, US goods also cost more for the rest of the world, reducing exports and increasing imports. And no, the debt will not have to be monetized. In fact, the Federal Reserve chairman is elected to terms that are independent of the president precisely to give it independence from those matters. |

|

|

|

|

|

#694 (permalink) | |

|

Still Free

Location: comfortably perched at the top of the bell curve!

|

Quote:

Dippin, I love you like a brother, man - you don't HONESTLY believe that the Fed chairman is not influenced by the executive branch, do you?

__________________

Gives a man a halo, does mead. "Here lies The_Jazz: Killed by an ambitious, sparkly, pink butterfly." |

|

|

|

|

|

#695 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

First, the IMF and the World Bank are completely independent from the UN. So whatever powerful force in the UN China has is not directly tied to their power in the World Bank or the IMF. Second, the IMF decision making is very different from the UN. In the UN it is generally one country, one vote. In the IMF, each nation's vote share is determined by their IMF quota (i.e., how much money they make available to the IMF). The United States provides 16.77% of the funding, so it has 16.77% of the vote. Japan provides 6.02% of the money, to it has 6.02% of the vote. China, in contrast, has 3.66% of the vote. So the idea that the IMF is somehow biased towards China, or harming the US in its decisions, is simply false. Furthermore, unless you are talking about "chaos theory" scenarios, where a butterfly flapping it's wings in Asia influences tornadoes in the United States, no, the IMF plays no role direct role in determining the Chinese exchange rate. It would if China needed IMF money, but since it doesn't, the IMF has no power over China. In fact, the standard IMF recommendation for exchange rates, which recently has been to float them, goes against what the Chinese have been doing. Same goes for the World Bank. Third, you have a mistaken notion of what an exchange rate should reflect. The "strength" of a currency is not determined by its numerical value regarding each other, but on it's yearly fluctuations and its impact on the trade account balances. |

|

|

|

|

|

#696 (permalink) |

|

Junkie

Location: Ventura County

|

Unemployment has gone over 10%. It is becoming increasingly clear that Obama's agenda is going to be tied to the success of the "rich", those who create jobs, those who create profits, those who get richer, those responsible for "trickling" down to the rest of us.

What is Obama going to do to kick start employment growth? Is he going to cut taxes, a supply side solution? Is he going to give businesses "special interest" incentives for employing people, catering to the "special interests" that he said has too much influence in Washington? Is he going to continue to blame it all on Bush? Is he going to think about it, the way he has been thinking about the Afghanistan military strategy? I think he knows he has to take a "supply side" approach to job growth. I just wish he would do it so we can get through this recession sooner and avoid a double dip.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

#697 (permalink) |

|

Who You Crappin?

Location: Everywhere and Nowhere

|

Does one track recession via jobless rate (which has grown) or by National GDP (which is also up)?

Not a loaded question; I have almost zero knowledge of economics, so I'm curious which is the more accepted methodology |

|

|

|

|

#698 (permalink) |

|

Junkie

|

Unemployment has always been a lagging indicator. That is we enter a recession and 6 months to a year later unemployment goes way up. Once we leave the recession it usually takes 6 months to a year for the jobs to recover.

Also supply side economics is BS. If we cut taxes we would be running even larger deficits and the people who got the tax cuts would just pocket the money. If you want to use tax dollars to create jobs then you need to create the jobs yourself. If we want jobs to recover now then the government needs to create a lot of jobs. But this would require money and that is something many don't approve of. |

|

|

|

|

#699 (permalink) | ||

|

Junkie

Location: Ventura County

|

Quote:

Quote:

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||

|

|

|

|

#701 (permalink) | |

|

Crazy, indeed

Location: the ether

|

Quote:

"a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." And no, the fact that people argue about just how to define it precisely does not make it subjective. So according to them this recession started on December 2007. If the GDP growth figures for the last quarter are confirmed next quarter, along with a rise in industrial production and sales, they will consider the current recession over: Business Cycle Expansions and Contractions Unemployment deliberately does not enter the "recession equation." And that is for a simple reason: unemployment figures always lag economic recovery. Even if every single business started hiring right now, it would still take 2 or 3 months for that to show on the official figures. Just as an example, the 81-82 recession ended on november 82, but unemployment only dipped below 10% on july 83. |

|

|

|

|

|

#702 (permalink) |

|

Junkie

Location: Ventura County

|

Speak for yourself. If I got a tax cut, I would invest it in growing my business. I have seen the pattern in my business. When i invest $1 in my business today I get a much better return on that dollar than if I just put it in my pocket. In my business my costs have gone up, sales have gone down. My access to new credit is zero. The cost of existing credit has gone up. What I need is access to new credit at lower costs, lower taxes, less regulation in order to grow my business. If I grow my business, I hire more people and I buy more stuff to operate my business.

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

|

|

|

|

#703 (permalink) | |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

Indicators, however, are generally divided by the delay between the indicator and the direction of the economy: leading (happens before the economy changes), coincident (happens at the same time), and lagging (happens after economic change). Examples:

So to answer your question, looking at GDP indicates what's happening to the economy now, and looking at unemployment figures suggests what happened to the economy a while back. So the recent growth in GDP suggests the economy is currently growing, but the unemployment rate is still increasing, suggesting that the economy was receding a while back. In a "trough," demand usually continues to drop, and so workers either continue to face layoffs or stalling income growth. But as demand is suppressed, so are prices, which keeps inflation at bay or even may result in deflation. Interest rates tend to remain low in this case, which encourages borrowing and spending. This eventually helps rebuild economic growth. Yes, exactly.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

|

#705 (permalink) | ||

|

Junkie

Location: Ventura County

|

Quote:

---------- Post added at 04:36 PM ---------- Previous post was at 04:34 PM ---------- Quote:

Supply siders have a lot to worry about when government (tax spending rather than tax generating) is a bigger and bigger share of GDP

__________________

"Democracy is two wolves and a sheep voting on lunch." "It is useless for the sheep to pass resolutions on vegetarianism while the wolf is of a different opinion." "If you live among wolves you have to act like one." "A lady screams at the mouse but smiles at the wolf. A gentleman is a wolf who sends flowers." |

||

|

|

|

|

#707 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

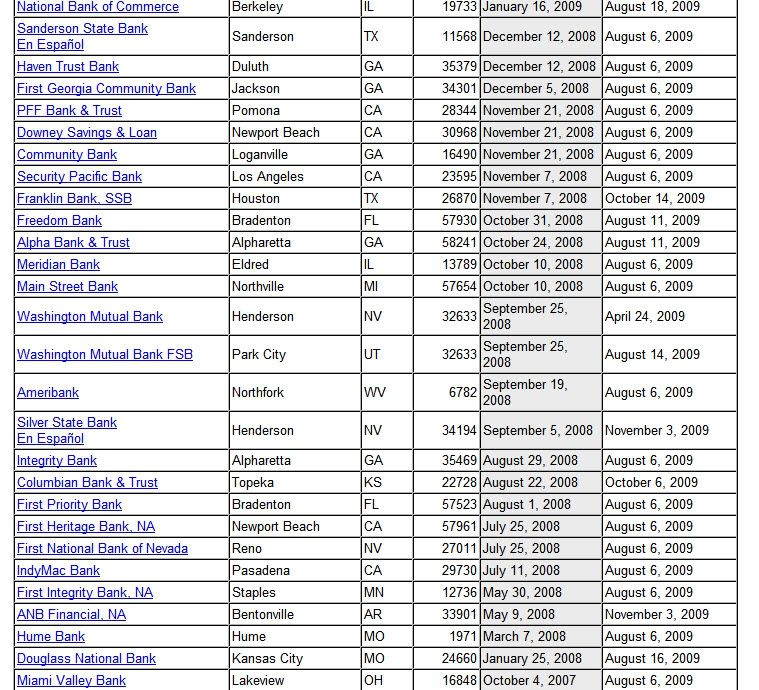

Between the double digit inflation and the triple digit bank failures... how are we to believe that the economy is getting better? 10% unemployment, 116 failed banks.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#708 (permalink) |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

And how do we know if Obama and his Admin. weren't doing what they're doing things wouldn't be worse? Unmeployment seems to be slowing the Dow is rising. Is was in a full out free fall by the time GWB left.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

#709 (permalink) | |||

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Well you should. Looking at the economy takes more than looking at today.

Quote:

Quote:

October was the retail sector's best month in over a year. So far, S&P 500 companies are reporting 15% above expectations (as dismal as they were). The home price index rose for the third straight month. Quote:

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|||

|

|

|

|

#710 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

Sanderson State Bank En Español Sanderson TX 11568 December 12, 2008 Haven Trust Bank Duluth GA 35379 December 12, 2008 First Georgia Community Bank Jackson GA 34301 December 5, 2008 PFF Bank & Trust Pomona CA 28344 November 21, 2008 Downey Savings & Loan Newport Beach CA 30968 November 21, 2008 Community Bank Loganville GA 16490 November 21, 2008 Security Pacific Bank Los Angeles CA 23595 November 7, 2008 Franklin Bank, SSB Houston TX 26870 November 7, 2008 Freedom Bank Bradenton FL 57930 October 31, 2008 Alpha Bank & Trust Alpharetta GA 58241 October 24, 2008 Meridian Bank Eldred IL 13789 October 10, 2008 Main Street Bank Northville MI 57654 October 10, 2008 Washington Mutual Bank Henderson NV 32633 September 25, 2008 Washington Mutual Bank FSB Park City UT 32633 September 25, 2008 Ameribank Northfork WV 6782 September 19, 2008 Silver State Bank En Español Henderson NV 34194 September 5, 2008 Integrity Bank Alpharetta GA 35469 August 29, 2008 Columbian Bank & Trust Topeka KS 22728 August 22, 2008 First Priority Bank Bradenton FL 57523 August 1, 2008 First Heritage Bank, NA Newport Beach CA 57961 July 25, 2008 First National Bank of Nevada Reno NV 27011 July 25, 2008 IndyMac Bank Pasadena CA 29730 July 11, 2008 First Integrity Bank, NA Staples MN 12736 May 30, 2008 ANB Financial, NA Bentonville AR 33901 May 9, 2008 Hume Bank Hume MO 1971 March 7, 2008 Douglass National Bank Kansas City MO 24660 January 25, 2008

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#711 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Yes, but there are number that can't lie.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#712 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

As far as not caring, it's not caring about it being GWB or Obama's fault. The historians and writers will sort out the blame. Right now there's work to do, not the blame game. Companies are stating their earnings in the best light possible. I don't believe that the stellar earnings are as stellar as they are. Enron had stellar earnings as did AIG, and the rest of Wall Street. It's easy to lie on paper.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#713 (permalink) | |

|

Living in a Warmer Insanity

Super Moderator

Location: Yucatan, Mexico

|

Quote:

For some reason I feel tempted to respond by posting the address and firm names of numerous lobbying groups. Though I have no idea what that would prove either.

__________________

I used to drink to drown my sorrows, but the damned things have learned how to swim- Frida Kahlo Vice President Starkizzer Fan Club |

|

|

|

|

|

#714 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

I sit in board meetings and help to craft annual reports and 10Ks from time to time. It's easy to shuffle one line of accounting into another line to make the best possibility of shitty numbers so that they look better. Write up some good text around it, and voila, it's potentially good for a few points up on the stock. GAAP and BLC allow for lots of liberty.

Quote:

You can see that the banks weren't in free fall as far as closures are concerned nor was unemployment. Graphs of those time periods would not show a sharp drop off as you are implying. FDIC: Failed Bank List

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#715 (permalink) |

|

Junkie

|

Where is the double digit inflation? Last I heard there was no inflation which is why there was no increase in social security payments this year.

Also please look back and read why unemployment is a lagging indicator. Look at every recession in history and you will see that unemployment lags behind the recession. Once the recession hits the job losses are coming and there isn't much you can do about it. Here is what I know. The economy appears to be out of the recession. That means jobs should start to come in 6 months to a year. In fact we already see the layoffs slowing. |

|

|

|

|

#716 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

If it's a lagging indicator, then the whole 1 year when people were saying, we're in a recession and it was supposedly "everything is fine", doesn't sit well with me and the situation now. I believe that the "recession is over" is just as much a line of bullshit. Stores that aren't able to meet their rents because they have no customers since the customers don't have jobs is what I'm seeing now in my neighborhood and area.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

|

|

#717 (permalink) | |||

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Quote:

I'm not trying to pump sunshine; I'm just trying to point out the indicators suggesting that the economy isn't all shit. Quote:

Quote:

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot Last edited by Baraka_Guru; 11-06-2009 at 04:11 PM.. |

|||

|

|

|

|

#719 (permalink) |

|

warrior bodhisattva

Super Moderator

Location: East-central Canada

|

Rekna, that's quite illustrative of what I've been getting at. Thanks.

__________________

Knowing that death is certain and that the time of death is uncertain, what's the most important thing? —Bhikkhuni Pema Chödrön Humankind cannot bear very much reality. —From "Burnt Norton," Four Quartets (1936), T. S. Eliot |

|

|

|

|

#720 (permalink) | |

|

Tilted Cat Head

Administrator

Location: Manhattan, NY

|

Quote:

If the economy is getting better then HOW is it getting better? By the same ponzi schemes before? Is it just moving credit monies back and forth? What's being produced to increase the GDP? By what I'm reading in the papers and in the company quarterlies, it's still not sustainable. Commercial mortgages are going to come due this coming year, a lot of the see-throughs that were supposed to be finished rentable buildings will not produce the expected jobs and tax revenue. Sorry, "fool me once shame on me, fool me twice shame on you." is what I'm going by here.

__________________

I don't care if you are black, white, purple, green, Chinese, Japanese, Korean, hippie, cop, bum, admin, user, English, Irish, French, Catholic, Protestant, Jewish, Buddhist, Muslim, indian, cowboy, tall, short, fat, skinny, emo, punk, mod, rocker, straight, gay, lesbian, jock, nerd, geek, Democrat, Republican, Libertarian, Independent, driver, pedestrian, or bicyclist, either you're an asshole or you're not. |

|

|

|

| Tags |

| obama, performance |

|

|